For smooth trade facilitation of international trade, it is necessary the players are acquainted with the general documentation requirements involved in International trade. Documents required will depend on the type of cargo and these include but not limited to the following;

A. Commercial document relating to the cargo

• Purchase Order

• Proforma/ Commercial Invoice

• Packing list

• Sales agreement

B. Financial document (Documents related to payment for the cargo)

• Telegraphic Transfers(TT)

• Bank guarantee • Credit note

• Cash receipt

C. Transport documents (Document relating to movement of cargo from country of export to country of import)

• Bill of lading • Freight Notes

• Insurance Certificate • Freight receipts

• Export Customs Declaration

D. Regulatory documents (Documents relating to safety of the cargo)

• Pre-shipment Inspection Certificates

• Exportation/ Importation permit

• Phytosanitary certificates

• Certificates of origin

• Fumigation Certificates

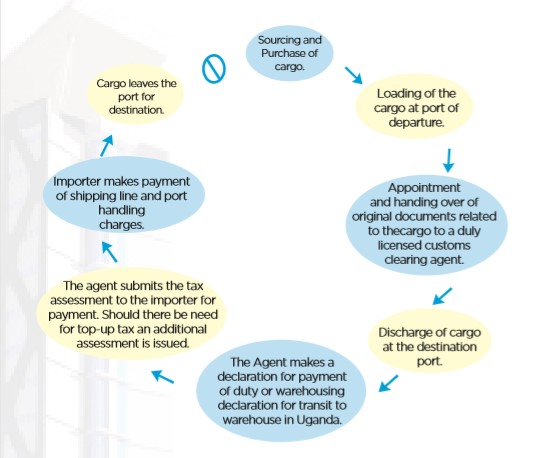

1) Maritime Cargo (By Ship)

• Sourcing and Purchase of cargo.

• Loading of the cargo at port of departure.

• Appointment and handing over of original documents related to the cargo to a duly licensed customs clearing agent.

• Discharge of cargo at the destination port.

• The Agent makes a declaration for payment of duty or warehousing declaration for transit to warehouse in Uganda.

• The agent submits the tax assessment to the importer for payment. Should there be need for top-up tax an additional assessment is issued.

• Importer makes payment of shipping line and port handling charges.

• Cargo leaves the port for destination.

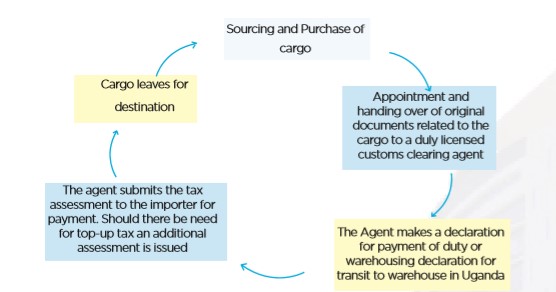

• Sourcing and Purchase of cargo.

• Appointment and handing over of original documents related to the cargo to a duly licensed customs clearing agent.

• The Agent makes a declaration for payment of duty or warehousing declaration for transit to warehouse in Uganda.

• The agent submits the tax assessment to the importer for payment. Should there be need for top-up tax an additional assessment is issued.

• Cargo leaves for destination.

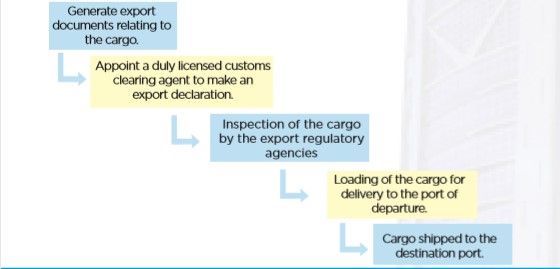

• Generate export documents relating to the cargo.

• Appoint a duly licensed customs clearing agent to make an export declaration.

• Inspection of the cargo by the export regulatory agencies

• Loading of the cargo for delivery to the port of departure.

• Cargo shipped to the destination port.