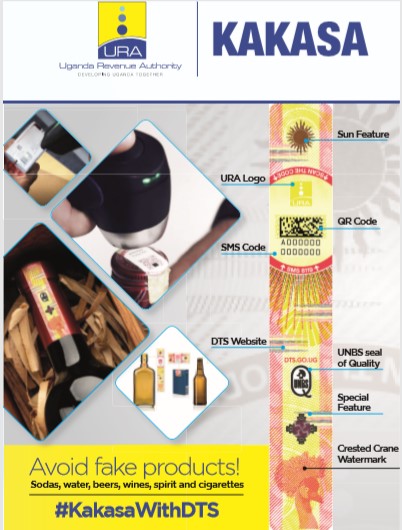

A Digital Tax Stamp is a marking that is applied to goods or their packaging and contains; security features and codes to prevent counterfeiting of goods and enable track and trace capabilities.

- Site registration

a. Go to the URA web portal on http://www.ura.go.ug, on the home page next to e-Services, click the link Digital Tracking Solution. Alternatively, go directly to the DTS Web app on: https://service.dts.go.ug.

b. Under the question “Don’t have an account yet?” Click Register.

c. At the registration page, enter the Taxpayer Identification Number (TIN) and click Register.

d. An email notification will be sent to the taxpayer’s E-tax registered email, with a link to the next step.

e. Open the received email, click on the link or copy the link and paste it as web address in your browser. This will redirect to the registration page.

f. Fill in all the mandatory fields and submit your application for approval. You will receive an email notification of successful submission of request.

g. Upon approval of the request, you will receive an email notification with the user name (labelled as Log in) and a temporary password.

h. Go to the DTS Web app on: https://service.dts.go.ug, and fill in the user name and password. This will prompt you to set up your own password, with a password policy displayed for guidance.

2. Product registration

To register products (Stock Keeping Units – SKU), please follow steps below;

a) Log into your DTS user account.

b) Click the module Products, then click the sub module Register products.

c) Fill in the bar code and click Search.

d) Provide all the product details in the mandatory fields.

e) Under Product Category, follow steps below;

i. If we have installed DTS equipment at your factory for automated affixing of stamps, and you produce Soda, Water or Beer, select Soda direct marking, Water direct marking or Beer direct marking respectively

ii. For water producers, all SKUs of 5 Liters and above will be affixed manually, therefore select Water as the product category

iii. If we have not installed DTS equipment at your factory, or you are an importer (stamps to be manually affixed), select; Soda, Water or Beer

iv. For other products (whether automated or manual affixing of stamps), select Tobacco, Wine or Spirit accordingly

f) Upload an image of the product/SKU (the size limit is 2MB). This step is mandatory.

g) Select the primary packaging type for a single product unit e.g. Glass bottle, PET bottle, Can etc. for beverage products.

h) Select the product’s appropriate unit of measure from Packaging Weight, Volume or Quantity, and select all for others. i.e

i. For Beverage products, select Packaging Volume from drop down, and select All for both Packaging Weight and Packaging Quantity

ii. For Tobacco products, select Packaging Quantity from drop down (number of sticks per packet of cigarettes), and select All for both Packaging Weight and Packaging Volume.

iii. Under the Production line field, follow steps below;

For manufacturers with automated lines and DTS equipment installed, select the appropriate SCL or SAS production line

For importers and manufacturers without DTS equipment (stamps to be manually affixed), select Virtual line

i) When all details are provided, click Save to submit your registration

a) Register for Local Excise Duty (if not already registered) then register for DTS.

b) Once you are registered, an account will be created for the user.

c) Login onto the DTS and place your orders for the stamps.

d) On approval of the order proceed to pay for the stamps.

e) When payment is submitted and cleared, you will receive an email notification. and then you will proceed to pick your stamps.

a) Login to your DTS user account.

b) Click on the module ORDERING then click the sub module Create Order. This returns the create order screen. (Take note of the required {mandatory} fields marked with an asterisk*).

c) Click the Site drop-down to select your Taxpayer name.

d) Provide a reference of your choice in the reference field.

e) Fill the comments field with any relevant accompanying communication (this field is optional).

f) If you are ordering for paper stamps, fill the Desired delivery date and the recipient data field (Name and NIN of the person to pick the stamps on your behalf).

g) If you are ordering for digital imprint codes, ignore the delivery date and recipient data fields.

h) Click Add items, select the type of stamps from SC reference drop-down, and fill in the desired quantity of Reels or Pack of stamps required. The total number of stamps for the Reels or Packs ordered and the applicable stamp purchase fees will display. (Please note that the total number of Stamps will equal the Quantity of reels or packs selected multiplied by the number of stamps in each reel or pack)

i) Click Save to add the order item, and your order details will be displayed. Note: You can delete the already added item(s) entered in step 8 by clicking the red bin icon. But you can also add further items by clicking the Add item(s) button, and following step 8.

j) Scroll down and click the Save button to submit your order. The order information page will be displayed for confirmation with the final save button at the bottom. If not satisfied with the details, you can click Cancel to return to the ordering screen.

k) If you agree with order details, click Save again and a notification of successful creation of the order will be displayed in a green background.

a) Click on the module ORDERING then click the sub module Manage Orders.

b) Click the Search button to display a report of your Order history.

c) Under the Status field, the order status will be, “Created”.

d) Upon approval of your order from URA, the status will change to “Waiting for Payment”, and a downloadable PDF of the PRN (for payment of Digital Tax Stamp fees) will be available in the Action field.

Reporting damaged/lost stamps

Manufacturers and importers of prescribed goods can account for lost, stolen or damaged stamps under the following conditions: The authorized user specifies:

a) Manufacturer’s or importer’s site from which stamps are lost/damaged/stolen

b) Report the matter to police in case of theft.

c) Gives a list of the affected Parking unit (PU) or a range of stamps

d) Indicates a declaration date.

Any person found in possession of lost/stolen/damaged stamps and fails to report it to URA commits an offence. On verification, if URA is satisfied that the stamp is lost/damaged/stolen, URA will authorize the offset of the verified loss/damage/theft from the total supply received.

Refunds on Damaged Stamps

A refund claim arises where manufacturer or importer returns already paid for unused stamps and shall be paid within ninety (90) days of the return of the stamps. A refund shall be granted on approval of returned stamps. A return of unused stamps occurs under the following circumstances;

a) Manufacturer stops producing the goods.

b) The goods are not imported or one imports a quantity less than the ordered stamps

c) The stamps reels/sheets are defective

d) The stamps are declared out of use by commissioner

In such instances the taxpayer should apply for a refund of the amount paid. The application shall be available on the Portal (inside taxpayer login and outside login).

While making payment, please note that: –

i. Digital Tax Stamp fees are payable in STANBIC BANK only, strictly using the PRN generated from the steps above.

ii. The taxpayer MUST quote the PRN in the payment instruction to Stanbic Bank because the PRN is the primary parameter for automated reconciliation.

a. Identify a Reel of stamps (Packaging Unit) to be used on a product/SKU and note its PU Number

b. Open the PU to reveal the stamps. You will notice that each stamp has a unique 12-digit alphanumeric code referred to as the Human Readable Code (HRC)

c. Affix a Range of stamps on units of the selected product/SKU, and take note of the codes/HRC for the First and the Last stamp used in your Range

The whole 12-digits of the HRC should to be quoted accurately, otherwise the activation will fail. To enable the correction of any mistakes which could occur, strictly take clear photographs of the First and Last stamp and keep them until activation is successful. The photographs will be required if you report any activation failures and require support.

| Stage | When to install Digital Tax Stamp |

| Automated production lines | Installation of the DTS shall be done on the production line and stamps shall be automatically activated on the line. |

| Manual production lines and imported products | • After registration of premises, stamps shall be manually affixed on the products • Stamps shall be activated using the on-line system accessible from the URA portal (http://ura.go.ug) • After logging on to the DTS, the manufacturer or importer will declare usage of labels to activate the stamps. |

| Imported products | Stamps can be affixed; • At the country of origin • Manually stamped at designated Taxpayer’s premises |

Activating tax stamps on automated production lines

a. Log into your DTS account

b. Click the module Digital Activation System, then click the sub module Declare Usage of Labels

c. Select your Site then select the SKU from the drop down list

d. The list of Packaging Unit numbers acquired for the relevant product category will display in the Packaging Unit window, with the level of use in percentage

e. Click on the used PU number and it will be highlighted with a blue background

f. Choose either Whole Reel activation or Range activation

i. Option 1: All Unused Stamps / Whole Reel activation. This option should only be used when all the stamps from the entire PU selected, have been used at once on a single product/SKU. To activate a whole reel, click in the checkbox next to the field- “All unused stamps”. Strictly ignore the checkbox if you only have a range of stamps to activate.

ii. Option 2: Range activation. In the Range input field, fill in the First HRC and the Last HRC separated by a hyphen. (leave no spaces) (illustration: ABCDEF123456-GHIJKL789123)

g. Fill in your Internal Production Batch Id, Operator name, Application date and Expiration date

h. Click Save usage to submit your declaration

i. Confirm the declaration using your login credentials (digital signature)

j. You will see a notification of successful operation in a Green background as an indication of completed activation of stamps.

Activating tax stamps on manual production lines and imports

The authorized user logs onto the URA web portal and specify the site name on which stamps will be activated, Stock Keeping Unit (SKU) on which stamps have been applied, Packing Unit (PU) to activate (whole or range), operator name, date of application and expiry date. The Digital Activation System (DAS) activates the stamp and sends the data to the server in URA.

i. Register for Local Excise Duty (if not already registered) then register for DTS

ii. Once you are registered, an account will be created for the user

iii. Login onto the DTS and place your orders for the stamps

iv. On approval of the order proceed to pay for the stamps

v. When payment is submitted and cleared, you will receive an email notification and then you will proceed to pick your stamps

Note:

a) If you are using automated production lines the codes/stamps will be automatically up loaded on to your DTS machine

b) If you are stamping manually or using paper stamps, on receipt of the notification, the digital stamps shall then be made available and shall be picked by the company’s authorized person from SICPA (U) office.

Incidences of activation failure

a. If you get an error message in a Red background after saving usage, this implies that activation has failed. Please re-check your entries for accuracy and try again.

b. If activation failure persists, share the photographs of the first and last HRC together with a screenshot of your web page showing the filled in details, by email to dtsgroup-gp@ura.go.ug for support.

NB: Non activated products shall not be considered ready for the market, and therefore NOT allowed on the market.

URA will provide a DTS machine on all automated production lines within a site to link it with DTS. Equipment to be provided include: a) A master server

b) An ink storage anti fire cabinet

c) A Secure Coding Line (SCL) or Scanning and Activation System (SAS) cabinet

d) A SCL/SAS beam

e) An encoder/coupling/shaft adapter/mounting plate

f) A barcode reading system with 1 or 2 cameras

The equipment will however not include:

a) An Ejection system

b) Cabling for internet connection between line equipment and server room

In order to ensure that the taxpayer’s production is not affected by DTS, the DTS equipment is strategically placed at the end of the production cycle i.e. after the manufacturer is satisfied that his product is ready for the market.

It can only stop production if:

a) Wrong stock keeping units are produced contrary to what had been selected

b) The DTS equipment is tampered with c) Un controllable power surges occur

a. Log into your DTS account.

b. Click the module Digital Activation System, then click the sub module Declare Receipt of Packaging Units.

c. Select your Site then select the Operation you would like to perform from the drop down list (i.e. Acknowledge Receipt or Reject Receipt)

d. Under the Available Packaging Units window, select the PUs you wish to Acknowledge Receipt or Reject Receipt, by clicking the “Add” button to the right of each PU Number, or clicking the “Add all” button next to the Search field. This will move the selected packaging units to the Selected Packaging Units window

e. In case there is a long list of Available Packaging Units, you can add a particular PU by typing the PU number in the Search input field, and clicking the Add button

f. Fill in the Operator name. This is the login name of the user carrying out this operation.

g. Click the Save Receipt button. This will open the Confirm Operation window

h. Confirm the declaration using your login credentials (digital signature)

i. You will see a notification of successful operation in a Green background as an indication of completed declaration.

Note:

a. All Reels of stamps are issued in form of Packaging Units (PU), clearly labeled with the applicable product category, and a unique PU Number

b. The Packaging units issued to you should be declared as received, before use