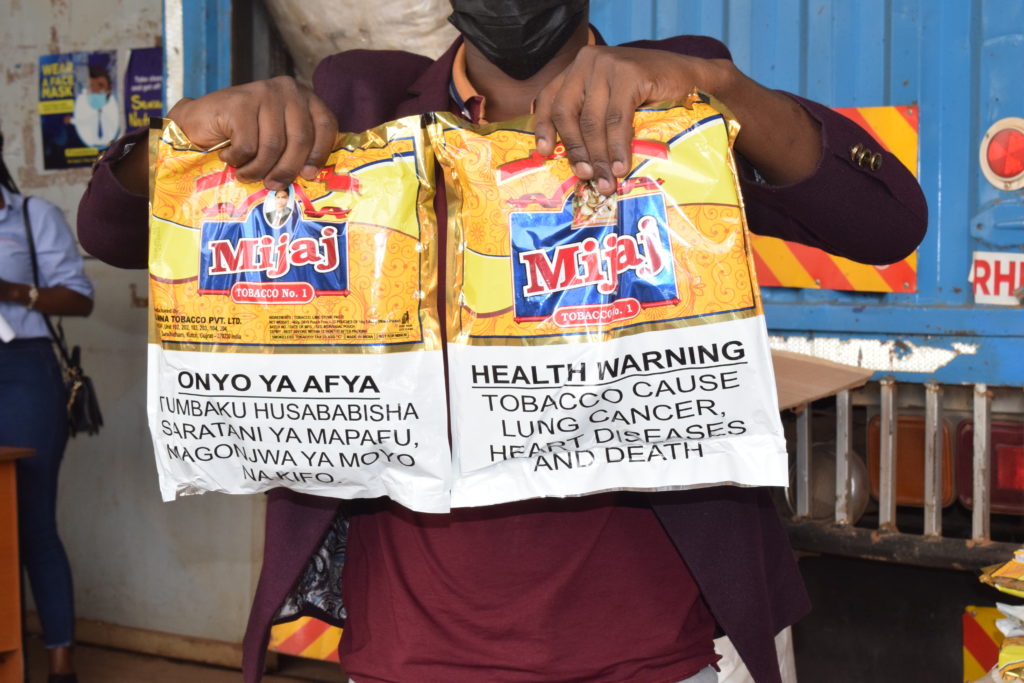

Smugglers evolving with new Tactics to dodge taxes

In spite of the tight security at the different borders, smugglers are growing new tactics to beat customs personnel at every checkpoint. Last Friday the smugglers in truck registration number UBA 174C coming from Eastern Uganda hatched a smarter way of concealing their contraband goods. They almost succeeded! Acting on intelligence, this trick was burst …

Smugglers evolving with new Tactics to dodge taxes Read More »