Performance Overview

COMMISSIONER GENERAL

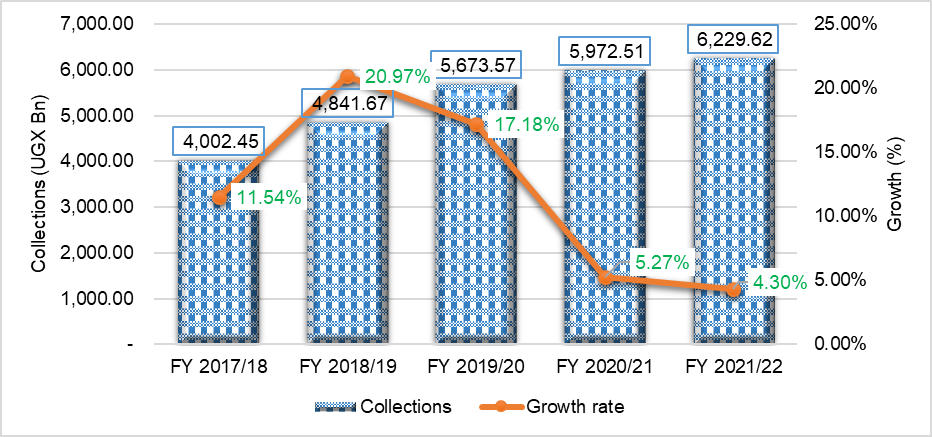

Overall Revenue Performance

Uganda Revenue Authority was given a revenue target, by the Ministry of Finance, Planning and Economic Development, of UGX 22,363.51 billion which is 16.10% (UGX 3,100.51) higher than the actual revenue collection from the last financial year. As a result, in the last six months, URA projected to collect 49.47% representing UGX 11,063.90 billion, an increase of 16.80% (UGX 1,591.43 billion) from the realised revenue for the same period last financial year.

The net revenue collections for the first 6 months of this FY 2021/22 were UGX 10,163.09 billion against a target of UGX 11,063.90 billion, representing 45.44% of the annual target. A shortfall of UGX 900.81 billion was incurred with a performance of 91.86%.

Figure 1: Trend Analysis of Net Revenue Performance for July to December

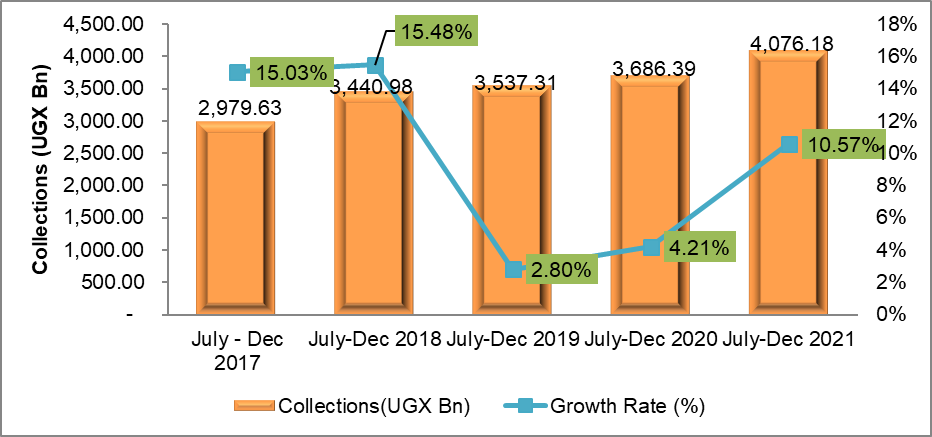

Domestic Taxes

In this period, domestic tax revenue collections were UGX 6,229.62 billion against a target of UGX 7,180.94 billion, registering a shortfall of UGX 951.32 billion, and a performance of 86.75%. The shortfalls were from direct domestic taxes (UGX 273.61 billion), indirect domestic taxes (UGX 487.20 billion) and Non-Tax Revenue (NTR) (UGX 190.51 billion). 20.03% of the domestic tax shortfall was from Non-Tax Revenue (NTR).

Figure 2: Trends of domestic revenue collection for July to December

International trade taxes

Customs tax collections in the first 6 months of the FY 2021/22 were UGX 4,076.18 billion against a target of UGX 4,102.51 billion, posting a shortfall of UGX 26.33 billion, and performance of 99.36%. However, a year to year growth of UGX 389.78 billion (10.57%) was realized this year compared to the same period in the previous Financial year 2020/21.

Figure 3: Trends analysis for international trade taxes for July to December

Key Highlights of revenue performance

Sector performance

During the period July to December FY 2021/22, 75.46% of the revenue was generated from the top 5 sectors. These are:

- The wholesale and retail trade sector which had the most significant contribution, amounting to UGX 3,031.01 billion (29.41%).

- The manufacturing sector followed with a contribution of UGX 2,413.36 billion (23.42%).

- The financial activity sector contributed UGX 1,064.43 billion (10.33%)

- The information and communication sector contributed UGX 880.97 billion (8.55%).

- Public Administration contributed 3.75%

The revenue growth in the Wholesale and retail trade sector is attributed to the wholesale of solid, liquid and gaseous fuels and related products. The growth of revenue from financial activities is attributed to contributions by mobile commerce due to gazetted regulations by the Bank of Uganda’s directive to all telecom companies to separate financial services from telecom services.

During the same period, there was a decline in revenue collection from the following sectors, in comparison to FY 2020/21;

- Information and communication declined by 14.55%

- Electricity, gas, steam and air conditioning supply by 37.79%

- Real estate activities by 10.78%

- Construction sector by 14.06%

The decline is attributed to a slow down in business in these sectors resulting from the COVID-19 pandemic impact.

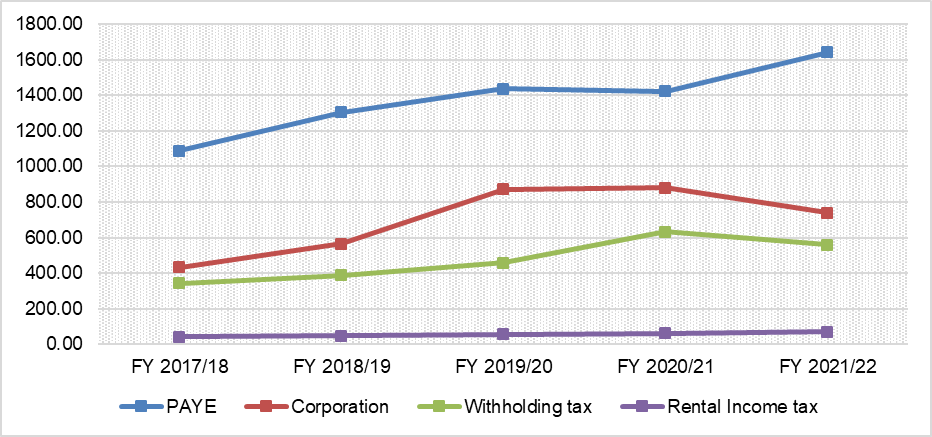

Direct Domestic Taxes performance

Direct domestic tax collections in the first half of FY 2021/22, (July – December 2021) were UGX 3,376.74 billion against a target of UGX 3650.35 billion and a deficit of UGX 273.61 billion, posting a performance of 92.5%. As a result, the direct tax collections for the period grew by UGX 62.09 billion (1.87%), compared to the same period in the FY 2020/21. In addition, there were surpluses registered in PAYE (UGX 156.45 billion), casino tax (UGX 8.84 billion) and tax on bank interest (UGX 1.63 billion).

Figure 4: Trends of direct domestic taxes tax heads’ collection for July to December

For PAYE, the surpluses are a result of arrears recoveries, increase in staff numbers in some sectors like finances, streamlined Government payment process, which enabled prompt payment of PAYE by most of the Government entities and MDAs. For casino tax, surpluses are attributed to arrears recovery of gaming tax.

Deficits were incurred in corporate tax (UGX 232.75 billion), rental tax (UGX 95.69 billion), withholding (UGX 53.26 billion) and treasury bills (UGX 14.75 billion)

Corporate tax and withholding taxes declined due to a reduction in tax contributions by some of the top taxpayers and a reduction in tax remittances, especially from withholding tax on dividends, respectively.

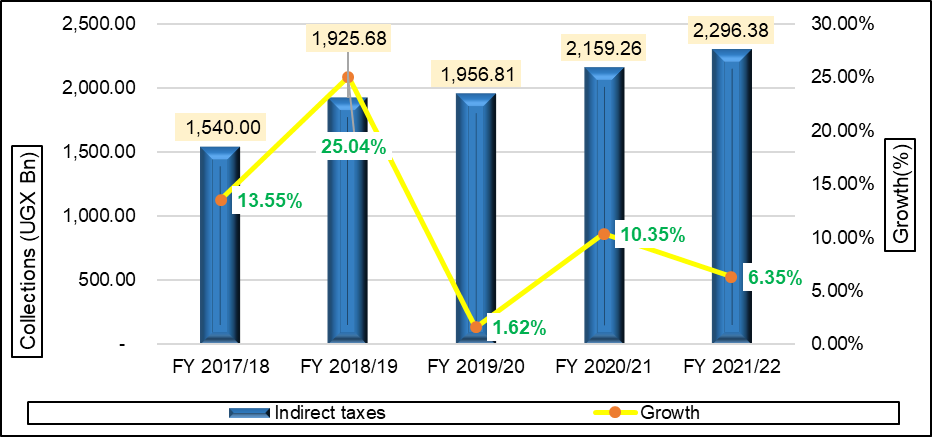

Indirect Domestic Taxes

Indirect tax collections for the period July to December 2021 were UGX 2,296.38 billion against a target of UGX 2,783.58 billion, registering a performance of 82.50% and a shortfall of UGX 487.2 billion. As a result, a growth of UGX 137.12 billion (6.35%) is noted compared to the same period in the FY 2020/21.

Figure 5: Indirect Domestic Tax Performance Trend for July to December

Value Added Tax Performance

Cumulatively, during the period July to December, VAT worth UGX 1,518.71 billion was collected against a target of UGX 1,874.11 billion registering a performance of 81.04% and a shortfall of UGX 355.40 billion. As a result, a growth of UGX 75.23 billion (5.21%) was registered compared to the same period in the previous Financial year.

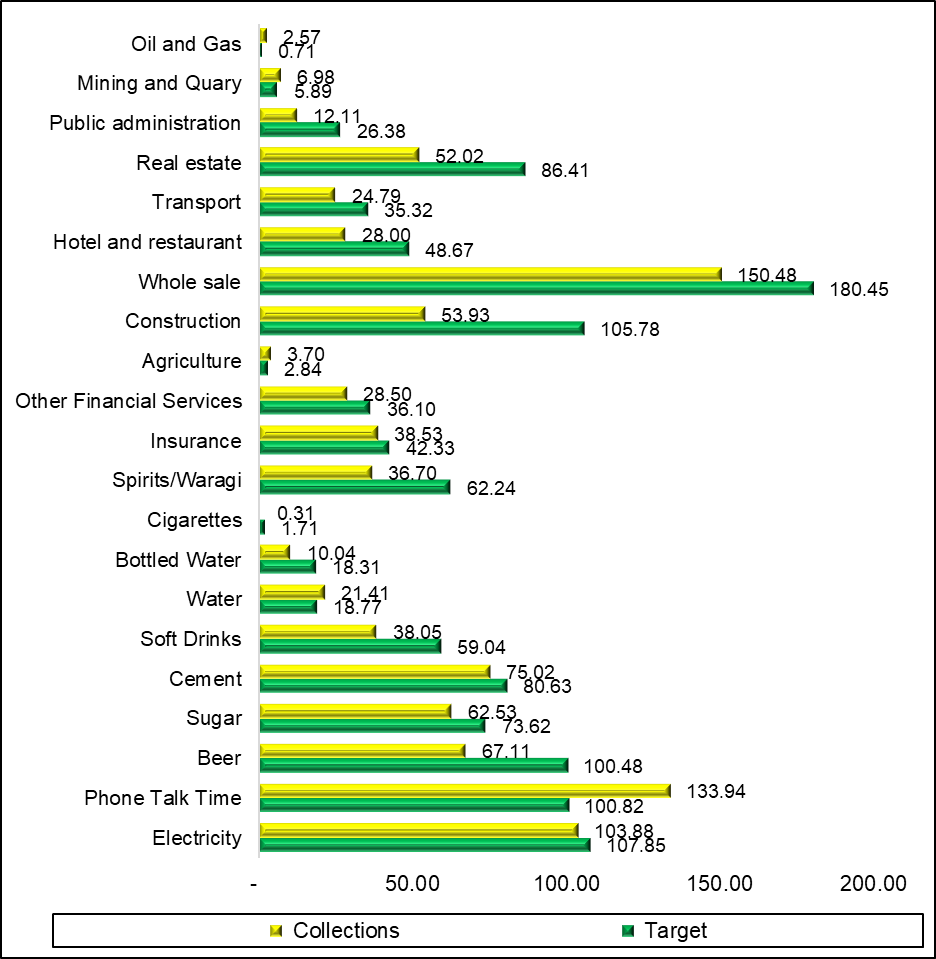

Figure 6: VAT Performance by-product for July to December FY 2021

The growth in VAT collections is attributed to an increase in standard-rated sales, growth in sales quantities for some taxpayers, a reduction in input costs, and increased debt recovery for other taxpayers.

On the other hand, the shortfalls are a result of high costs of investments, growth in export sales, and operationalization of the COVID-19 policy in which the upcountry tourism hotels were allowed an indefinite exemption of VAT on accommodation since July 2020. In addition, COVID-19 restrictions derailed the transport sector due to limitations in passenger numbers.

Local Excise Duty Performance (LED)

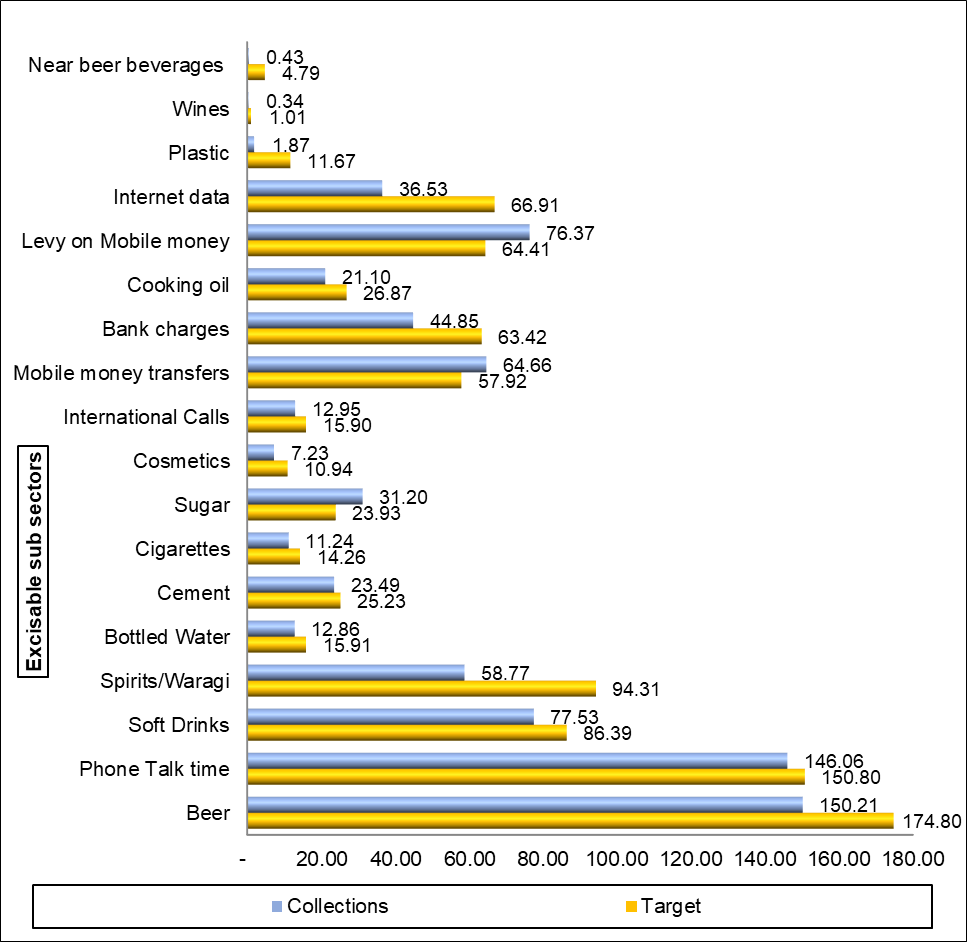

LED worth UGX 777.67 billion was collected against a target of UGX 909.46 billion hence performance of 85.51% and a shortfall of UGX 131.79 billion. However, a growth of UGX 61.89 billion (8.65%) was registered compared to the same period in 2020.

Significant surpluses were realized in the levy on mobile money withdrawals (UGX 11.96 billion), sugar (UGX 7.27 billion) and mobile money transfers (UGX 6.74 billion).

Figure 7: LED collections to target by-product for July to December FY 2021/22

Surpluses in the two mobile money levies resulted from strategies aimed at the financial inclusion of the people who have been left out by traditional banking across the country and the creation of several product variations for the consumers, including microloans; savings; and international money transfers. Sugar experienced an increase in sales by 60.87% compared to the same period last year.

Performance of Non-Tax Revenue

The Non-Tax Revenue (NTR), including Appropriation in Aid (AIA), collected was UGX 556.50 billion against a target of UGX 747.01 billion, posting a deficit of UGX 190.51 billion and a performance of 74.50%. NTR contributed UGX 369.69 billion with a performance of 93.74%, while AIA contributed UGX 186.80 billion with a performance of 52.98%.

This shortfall is partially caused by the delay of the on-boarded MDA to adopt the collection of NTR through the URA portal, thus significantly affecting the NTR collections expected from the newly on-boarded entities. Despite the directive and several engagements, some MDAs have not heeded the call to onboard their collections through the URA portal.

International trade taxes performance (Customs)

In the period July to December 2021, Customs collected revenue worth UGX 4,076.18 billion against a target of UGX 4,102.51 billion posting a performance of 99.36% and a deficit of UGX 26.33 billion. However, a year to year growth of UGX 389.78 billion (10.57%) was realized from July to December 2021 compared to July to December 2020.

In addition, significant surpluses were recorded in VAT on imports by UGX 155.05 billion, petroleum duty by UGX 8.73 billion, a surcharge on imports by UGX 6.06 billion and excise duty by UGX 0.38 billion. However, a significant shortfall was registered in; import duty worth UGX 101.37 billion, withholding tax by UGX 20.64 billion, temporary road licenses by UGX 9.69 billion, infrastructure levy by UGX 7.16 billion and export levy worth UGX 57.67 billion.

It was observed that all tax heads registered positive growth rates except for withholding taxes on imports that were reduced by 20.17% and surcharge on used imports by 6.1% during the period July to December FY 2021/22 compared to last F/Y.

Key International trade taxes observations in the first half of FY 2021/22

- The decline in import and export value by 24.22% and 54.53%, respectively, negatively impacted international trade. The top imported items that registered a decrease were; medicaments, motor vehicles, worn clothing and insecticides. Whereas the top exported items that registered a decrease were; plywood, salted/dried fish, milk, oil seeds and oleaginous fruits.

- Decrease in tax yield by some items such as personal motor vehicles, plastic footwear, cigarettes, woven fabrics and insulated wires, among others.

- Tax policy on some exports such as a levy of 5% on a kilogram of processed gold, 10% on the value of unprocessed minerals and the impososition of a tax on fish maws and leaf tobacco. This has resulted in no export of processed gold, reducing the export of fish maws and unprocessed minerals.

- Less than projected growth in revenue and smuggling. In the period July to December, international trade tax collection grew by 10.57% against the projected growth of 11.29%. This was due to the reduction in international trade and increased smuggling of commodities like wheat, garments, cooking oil, fuel and lubricant oil.

- Reduction in fuel volumes

Tax Register expansion:

During the period of July to December of the FY 2021/22, 182,553 new taxpayers were added to the taxpayer register. As a result, as of the end of December 2021, the taxpayer register had 1,966,106 taxpayers. Of these, 150,849 were non-individuals, and 1,815,257 were individual taxpayers. This represents a growth of 10.24% against a targeted growth of 7.50%. Of those new taxpayers, in the last six months (first half of the FY 2021/22), at least 33,341 of them became value taxpayers, from whom UGX 13.12 billion was generated.

Outlook for the second half of FY 2021/22

Revenue Outlook

The revenue target for the second half of the FY 2021/22 inclusive of January 2022 is UGX 12,328.51 billion, which accounts for 55.13 per cent of the annual target inclusive of the accumulated deficit for the period July-December 2021. URA purposed to collect UGX 1,919.65 billion in January 2022, of which UGX 1,791.55 billion had been collected by the end of January 2022 before final reconciliations.

Strategic Mitigation measures

For the remaining part of FY 2021/2022, the following reforms will be implemented to increase on revenue collections and tax to GDP ratio to 14.99%;

Alternative Dispute Resolution

To further encourage voluntary compliance, we adopted the use of Alternative Dispute Resolution (ADR) to amicably resolve tax disputes with taxpayers. Through the ADR mechanism, 3 (three) cases were amicably resolved outside the court process yielding UGX. 75.8Bn in revenue collected for the period 1st July 2021 to 31st December 2021, thus unlocking revenue that had been locked in some of the Court cases with some of our Large Taxpayers.

Cumulatively, a total of 15 cases have so far been settled through ADR ever since the initiative was introduced in June 2020, and URA has so far collected revenue of UGX. 285.8Bn and USD. 10.4Mn. This initiative has proved to be very effective in resolving long-standing tax disputes. In addition, it has further improved the relationship between the taxpayers and URA since the ADR is conducted in an unbiased, non-confrontational and cordial environment.

In addition, we have embarked on a cost-efficient service-centric approach by listening more to the concerns and being more responsive to clients concerns. We also encourage taxpayers to embrace the voluntary disclosure avenue by doing a tax health check and cleaning their tax account without waiting for penalties.

Strengthen the implementation of smart business solutions of Digital Tax Stamps and Electronic Fiscal Devices

URA will implement approved structures to ensure sustainability and expand on the traced and tracked products beyond the current eight products (cigarettes, beers, sodas, water, wines, spirits, sugar and cement). Continuous engagement of the relevant stakeholders will also be conducted to reduce the current legal disputes and appeals. These solutions have grown the revenue contributions from the VAT and LED tax heads. The key features of track and trace capabilities, real-time exchange of production and transaction data, simplified bookkeeping to enhance business monitoring, quick processing of refunds, access to information at a click of a button and a comprehensive view of the business. These are all efforts towards curbing illicit trade and eliminating uneven playfields for taxpayers.

Ensuring effective implementation of Domestic Resource Mobilization Strategy (DRMS)

We will continue to implement DRMS strategies like; leveraging information technology to implement the tax policy and administrative measures. This is in addition to improving and strengthening stakeholder relations and engagements with the private sector, Government Agencies, and external Revenue Agencies in order to leverage each other’s strength in achieving our mandate. The initiatives under DRMS are geared towards growing our tax to GDP ratio to 20.99% by FY 2024/25, thus growing the locally generated revenue contribution to the National budget and further reducing the National debt burden.

Simplifying our key processes

Effective January 1, 2022, we started issuing the instant Tax Identification Numbers (TINs) to individual taxpayers through an upgraded web-based application form. Simplifying processes like the TIN acquisition is URA’s new direction towards being a business enabler to improve tax compliance and improving service delivery with client-centric approaches.

Enhance the URA client service support

We have improved and standardized our contact centre service offering by providing 24/7 customer support through a multi-faceted approach. We have also introduced the Whatsapp and webchat available on the URA web portal and the URA Whatsapp number, 0772-140000. The AskURA app is also on IOS to enable Apple users to access the URA office at their convenience. These platforms extend self-help services to more persons, especially the Small and Medium Enterprises and all Ugandans both at home and in the diaspora.

Mobile Tax office

In addition to the above, URA launched the mobile tax office in July to further intensify tax education and outreach services. To date, the Tujenge bus has combed the remote areas in Kamuli, Iganga, Mbale and Soroti, Kampala, Luweero and Nakaseke. For the period under review, the total number of taxpayers registered on the mobile office stands at 1,634, and of these, 1,583 are individual registrations while 51 are non-individual registrations. The mobile tax office is scheduled to reach out into the mid-western and northern regions before the financial year ends.

Deepen Taxpayer Education

We will continue to demystify the tax regime to help all taxpayers understand tax. The needs-based strategy equips all our taxpayers with the relevant knowledge of their responsibilities, rights and obligations in revenue mobilization. In addition, we are expanding our awareness efforts with enhanced public outreach door-to-door outreaches together with the mobile tax to foster tax register expansion efforts.

Conclusion

The journey to Uganda’s economic independence is bound to find some hurdles. Still, we are confident that the digitalisation of processes, enhanced stakeholder collaboration, strengthened sector-based tax education, client-centric approaches, and data analysis and optimisation will get us to self-sufficient status as a nation.

We encourage taxpayers and the public to embrace these offerings and ease their compliance. URA also pledges to continue supporting the taxpayers as we collaborate to develop Uganda together.