BY CHELANGAT SARAH MUZUNGYO

There has been growing anxiety in the business community due to a halt in the automated issuance of credit notes. This process has been amended by introducing a requirement for a credit note to be approved by an authorised officer of the Uganda Revenue Authority (URA). As a result, companies whose operations involve a frequent return of products are not able to adjust their declarations in real-time.

The change of credit note approval process from a digital to a manual process is an administrative decision. Unlike the claims that URA is banning the issuance of Credit Notes, the URA is actually receiving and processing credit notes.

The decision to change the process was guided by analytical observations where some taxpayers were abusing the system by issuing credit notes after the system had matched the input and output taxes. The initiator of the credit note would then issue a credit note to reverse the output tax declared, but the input tax would remain uncancelled.

As a result, URA has temporarily put on halt the auto-approval process from completion through the Electronic Fiscal Receipting and Invoicing Solution (EFRIS) portal to having claims made using a downloadable form which will be approved after validation and scrutiny of transactions.

A Credit Note is an official document issued to a customer by a supplier when an earlier transaction needs to be cancelled or adjusted. It may also be issued when there is an error in invoicing or any other reason that may warrant reversal.

Section 30 of the VAT Act provides that where a tax invoice has been issued in the circumstances specified in Section 22(1)(e), and the amount shown as tax charged in that tax invoice exceeds the tax properly chargeable in respect of the supply, the taxable person making the supply shall provide the recipient of the supply with a Credit Note.

Section 22 of the VAT Act provides circumstances that give rise to the issuing of Credit Notes, which include: a) cancellation of the supply; b) fundamental variation or alteration of the nature of the supply; c) alteration in the previously agreed consideration for the supply by agreement with the recipient of the supply, whether due to an offer of a discount or for any other reason; d) the goods or part of the goods have been returned to the supplier; e) the services or part of the services have been altered or cancelled, and f) there was an error in the original invoice issued by the supplier.

The same section in the VAT Act notes that taxpayers are supposed to issue credit notes when amending details on a fiscalised tax invoice; however, how this process is administered is the discretion of the Commissioner General.

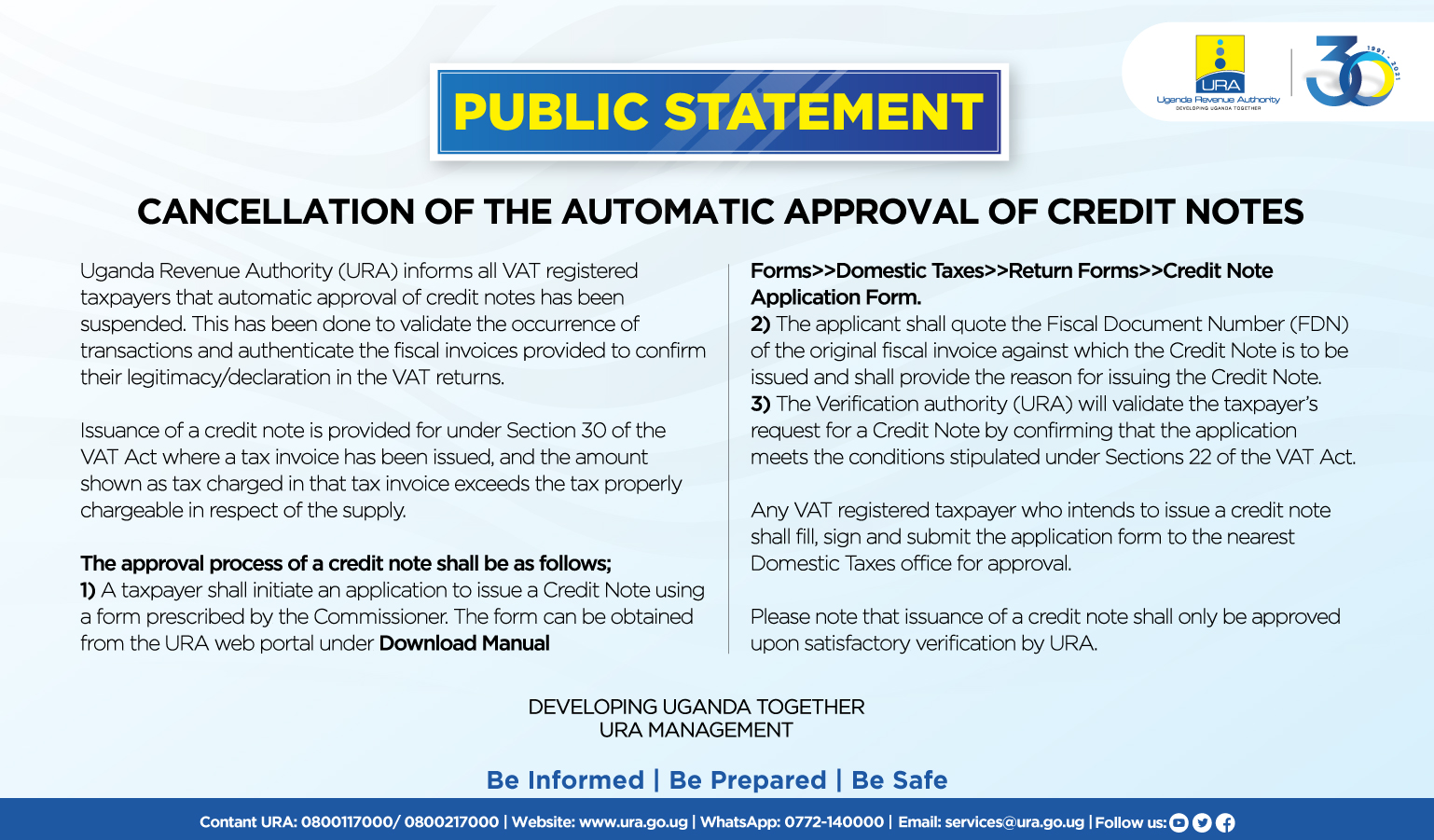

In the meantime, processing and approval of Credit Notes shall be the responsibility of URA officers authorized by its Management after satisfactory verification and scrutiny.

A taxpayer will initiate an application to issue a Credit Note using a form prescribed by the Commissioner (uploadable from the web portal), quoting the Fiscal Document Number (FDN) of the original fiscal invoice against which the Credit Note is to be issued while providing a reason or reasons for issuance of the Credit Note.

URA will then validate the taxpayer’s request for a Credit Note by confirming that the application meets the conditions stipulated under Sections 22 of the VAT Act as mentioned above.

The transaction will be validated to confirm its authenticity as part of the process. The buyer and seller may be contacted to confirm the need for the Credit Note. The verification officer will also ascertain whether the buyer has not fully claimed the input tax credit in respect of the transaction. Where the buyer has claimed input tax credit on the part of the transaction being adjusted, the verification officer shall issue an additional assessment to the buyer, equal to the tax amount on the Credit Note before approving the Credit Note issued by the seller.

For a Credit Note in respect of supplies to a final consumer, the seller will be required to provide proof of refund to the buyer before the credit note is approved.

If the Credit Note is due to damaged or expired products, an inspection will be carried out, and a report made. In addition, court or tax appeal rulings that decide that the transaction/e-invoice is cancelled will be authenticated.

Once URA is satisfied with the application, authorized personnel shall log into EFRIS, initiate the Credit Note issuance task for approval. The approving authority will make appropriate decisions with remarks on whether the application is approved or rejected before closing the task.

Taxpayers are advised to cooperate with URA by embracing this change as URA endeavours to fight tax fraud and reduce revenue leakages as we look for a better and user-friendly solution.

The writer is the Commissioner Domestic Taxes, Uganda Revenue Authority

For more information on Credit Notes, join the Tax Mchuzi Webinar on Friday 31st December 2021 starting at 10 am.