How can a landlord genuinely declare what they earned from their property?

The starting point is registering for taxes with URA. In order to be registered for taxes means one has to obtain what we call a tax identification number.

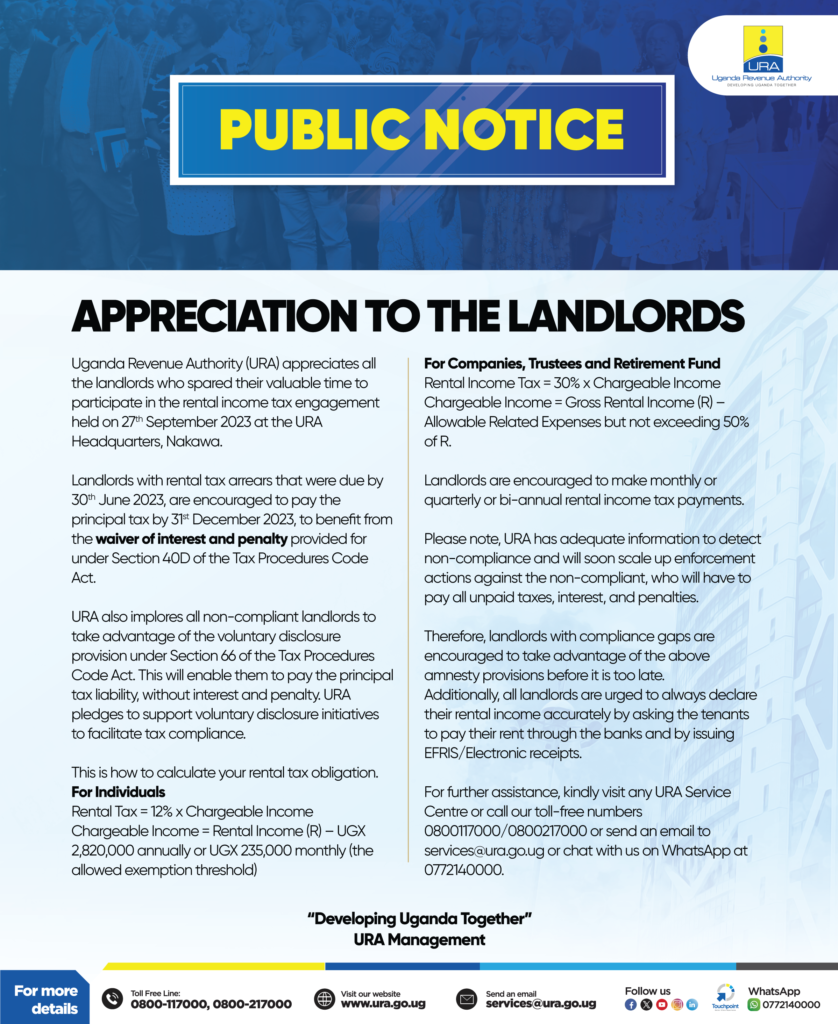

So if you are a landlord and you have a TIN with a clear indication that your source of income is rental income, the next step after registration is filing of the return where you are supposed to go to our URA web portal and then enter details of the income that you earned. Luckily, this declaration form has been simplified. It is now web based and the computations of tax are automatically done for taxpayer. As a landlord, particularly the individuals, all you need to do is have your books somewhere and indicate how much your earning on a monthly basis which will eventually will be translated into annual, then you make the declaration of your gross rental annual income and then the tax free threshold of 2,2820,000 will be reduced. It will automatically be computed in the web based form provided that is provided on the URA web portal and where applicable tax of 12% is also automatically applied. So as you submit, there will be a clear indication of the tax that has been generated from the gross rental income which you have declared in the web based form.

How many TINs does one need when operating a rental business?

Many people who are formally employed get TINS for employment purpose and then later through their savings they build some rentals and then begin to believe that they are supposed to get another TIN.

A TIN is a unique identifier for a taxpayer and it is issued once so no single taxpayer should have more than one TIN. The difference here is if you are earning employment income and you also have rentals there will just be an indication on your TIN that you are an employee but you have another source of income which is rental. Now the obligations for these different sources of income differ. If you are an employee, the tax for an employee is paid through the PAYE, 30% deducted at source by your employer. As an employee you have no further obligations on that. However, if you have rentals in addition to your employment income, the obligation that I shared earlier in terms of filing of the return and payment of the resultant tax lies with you.

What happens when a taxpayer fails to comply with payment of rental tax?

Non-compliance is very costly. Compliance is at three major levels, the first is registration when one obtains a TIN. The second is in filing of your returns and the third is in making payment. In there, one needs to make honest and accurate declarations principally those are the obligations. And when you do not comply with any one of these obligations, there are consequences.

I will start with failing to comply with the obligation to file a return. The statutory timelines within which these returns are expected to be filed. For individuals, we run a 12 months’ period, what we call a financial year and rental income is charged on an annual basis. In a given financial year, the individuals have an obligation to file what we call a provisional return. A provisional return is where the tax payer makes a declaration of their estimated income for the 12 months’ period.

Also for individuals, one is expected to file their individual return within the first 3 months of the financial year that is; July, August and September. So by 30th of September, every individual who earns rental income is expected to make a declaration through a return of their estimated rental income for the 12 months.

How does one know how much tax they are to pay?

It is an estimate we all know that if you have your 5 rental units with10 tenants in them and you have a bit of historical information, you have an estimate of how much will be paid over the 12 months’ period, so you make the declaration within the first three months. However, you opportunity to continuously amend it as the financial year progresses. So where you are found on the wrong side of the law is if you don’t estimate within the first three months.

When you make the estimate as an individual, there is a resultant tax which represents tax on estimated income for the 12 months’ period. You have an obligation to make payment of that tax in four quarterly instalments. The first quarter of that will be due by the 30th of September when the return is also due, then second quarter will be due by the 31st of December, the third quarter will be due by the 31st of March and 4th and final quarter will be due by 30th of June . This mean you have met your obligation to file a provisional return and also make payment of the resultant quarterly payments of the resultant tax. Now when the financial year ends, you now have actual results of what you generated in the 12 months’ period.

For the final return, URA gives you 6 months towards the end of the financial year. In reference to this financial year, the final return will be July 2023 up to 30th December 2023. So when filing a final final return provide actual details of the rental income you earned that financial year that ended.

Does someone have to move to URA offices to file for returns

No, as URA we have made significant strides in making compliance for the taxpayers easy and seamless. These returns can be filed in the comfort of one ‘s home because they are web based returns. Reason: With internet, one can still access the URA web portal even when out of Uganda

In addition to our online service platforms, we also have URA touch points spread across the country. We have over 40 URA touch points where a taxpayer is not able to access internet, they have the opportunity to walk to the nearest URA office.

We have other options like the Tujenge buses that move to places where we do not have offices and offers tax services on the go in far to reach places to allow taxpayers comply with their obligations of filing returns and making payment of the resultant tax. We believe that with these options depending on what is convenient for a taxpayer , they are able to go online or walk to a URA office. During peak times, we also have extended work hours for our staff to support taxpayers. URA also has an active call Centre which works almost 24 hours and anyone can reach out.

We believe with these variety of channels, compliance should be a much easier job because we are committed as URA to walk this compliance journey with our taxpayers.

This interview still continues with another series to understand in depth what the sector is and how it is taxed.