By Anan Prisca, Media Management

As Uganda Revenue Authority walks the path of liberating Uganda from the pains of economic dependency, tax literacy and education are now more than ever at the top of the Taxman’s agenda as a facilitator for voluntary tax compliance.

As such, URA is ensuring that the tax gospel reaches all taxpayers with a special focus on persons with disabilities (PWDs).

“One of our aspirations as URA is to be forerunners in building an all-inclusive tax administration where everyone has access and can consume tax literature in a clear way. For example, the use of braille technology is one of the avenues that URA has harnessed to enable visually impaired persons access tax information to learn about their rights and obligations as citizens,” the URA Commissioner General John R. Musinguzi noted.

URA has partnered with Uganda National Association of the Deaf (UNAD) to provide taxation services to persons with hearing impairments such as TIN registration, return filing and payments, financial literacy and other tax education and advisory services to the deaf.

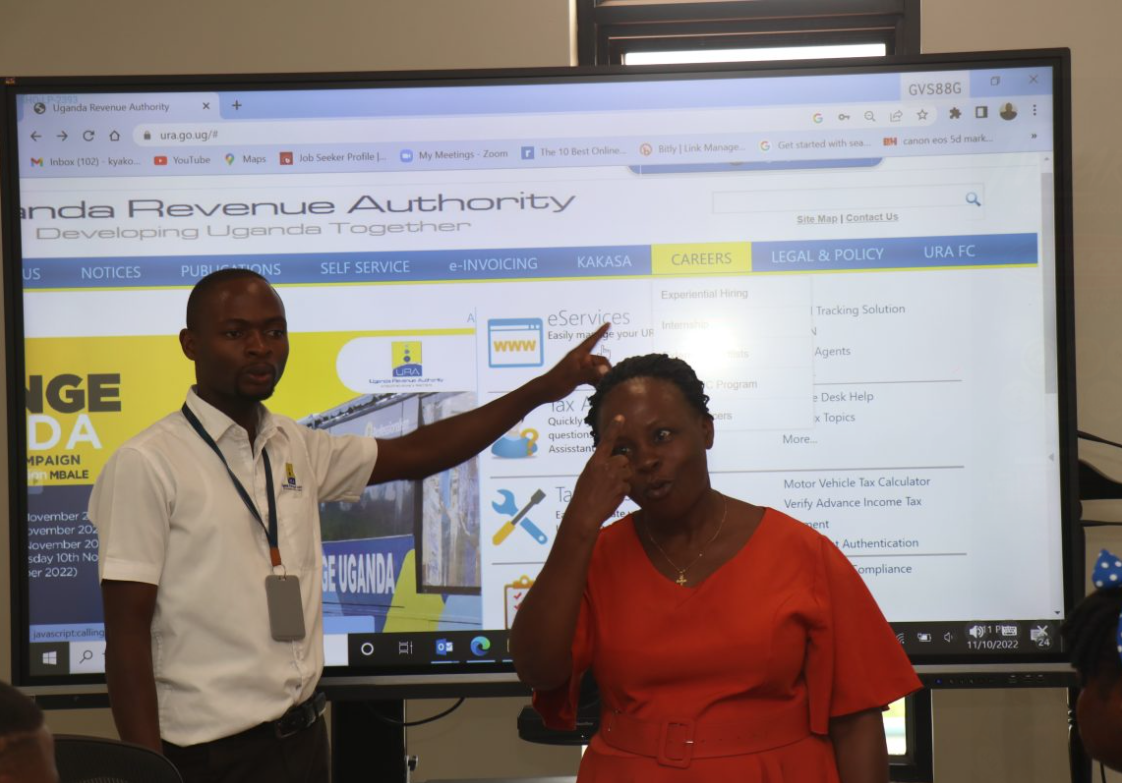

URA does this through public lectures with an interpreter for sign language to educate and support the deaf community on their tax rights and obligations and how they can avoid tax liabilities and inconveniences.

Recently, URA sensitized the deaf community in Iganga district on how they can grow their businesses through formalization which connects them to other registered taxpayers. URA has held 8 engagements in this financial year with different categories of PWDs.

URA also met and agreed to partner with the Makerere University Association for the Deaf Students (MUKADS). This to facilitate production of tax literature that is inclusive towards persons living with disabilities.

Commissioner Domestic Taxes, Sarah Chelangat said, “for any business to thrive and earn good profits, it must be formalized. As URA, we have made business formalization so easy by working together with URSB where one can acquire a business name and TIN at one stop shop with in a day. We also handhold them through the on-boarding to ensure that they understand their obligations such as keeping proper records, filing and paying in time.’’

She urged PWDs engaged in informal business to formerlize in order to access government funds in the Parish Development Model (PDM) program for their economic development since it is one of the requirements.