by Kabahweza Kamugisha Allan, Media Management

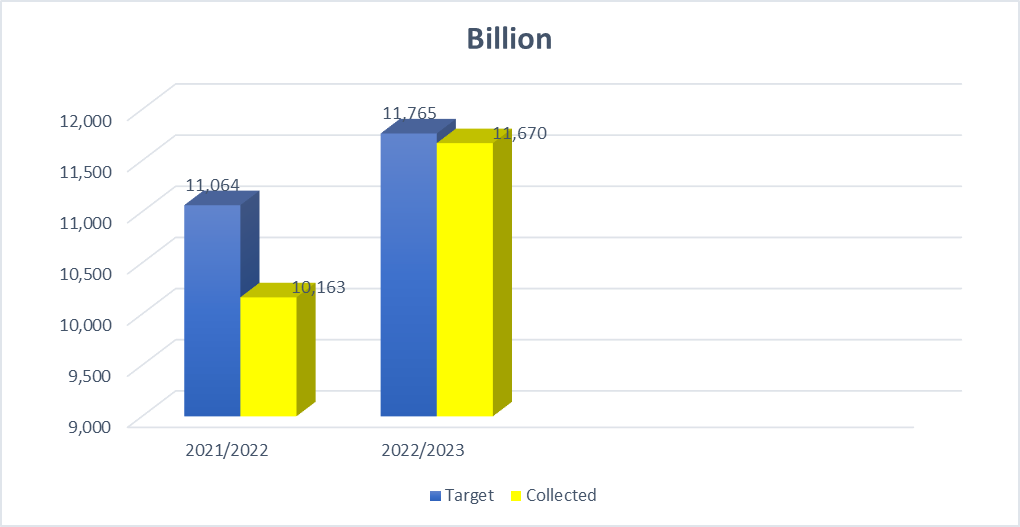

Uganda Revenue Authority has registered a growth in revenue in the first half of the 2022/2023 financial year compared to the same period last financial year 2021/2022. The target for July to December 2022 was UGX 11,764.83 Billion and the net revenue collected was UGX 11,670.03 Billion.

While sharing the tax body’s revenue performance with the media recently, URA Commissioner General John R. Musinguzi noted that despite not achieving the target and the hard-economic times, revenue collections grew by UGX 1.5 trillion (14.8%).

Musinguzi noted that there was a great performance in internally sourced revenue (domestic taxes) collections of UGX 7,470.03 billion against a target of UGX 7,450.71 billion, creating a surplus of UGX 19.3 billion. PAYE, casino tax, rental tax and tax on bank interest catapulted major surpluses in the July to December 2022 collections.

The Commissioner General elucidated that the increase in revenue was due to growth by companies whose PAYE augmented owing to bigger staff numbers, enhanced compliance initiatives, and payment of arrears for non-tax revenue such as express police penalties and demand for government services including business registration, work permits and tourist visas.

On International Trade taxes, surpluses were registered in import duty, temporary road license and surcharge on imports. The surpluses are attributed to the increase in import goods such as motor vehicles, wheat, palm oil and motorcycles.

The top performing sectors highlighted for their contribution to the targeted revenue include wholesale and retail, manufacturing, financial activities, information & communication and public administration, defence and compulsory social security contributions.

Additionally, with the recovery of the economy from the COVID-19 pandemic, the arts, entertainment, recreation, accommodation, and construction sectors have continued to register significant growth.

URA is expected to collect UGX 13,481.54 billion during this remaining half of the financial year to hit the annual target of UGX 25,151.57 billion.

Key initiatives that will be employed are further emphasis on tax education and sensitization, stakeholder collaboration and engagements as well as the continued roll out of technology such as EFRIS and skilling of staff.

‘’We are confident that we shall achieve the target given to us in the remaining six months,’’ Musinguzi avowed.