By Florence Namuganza

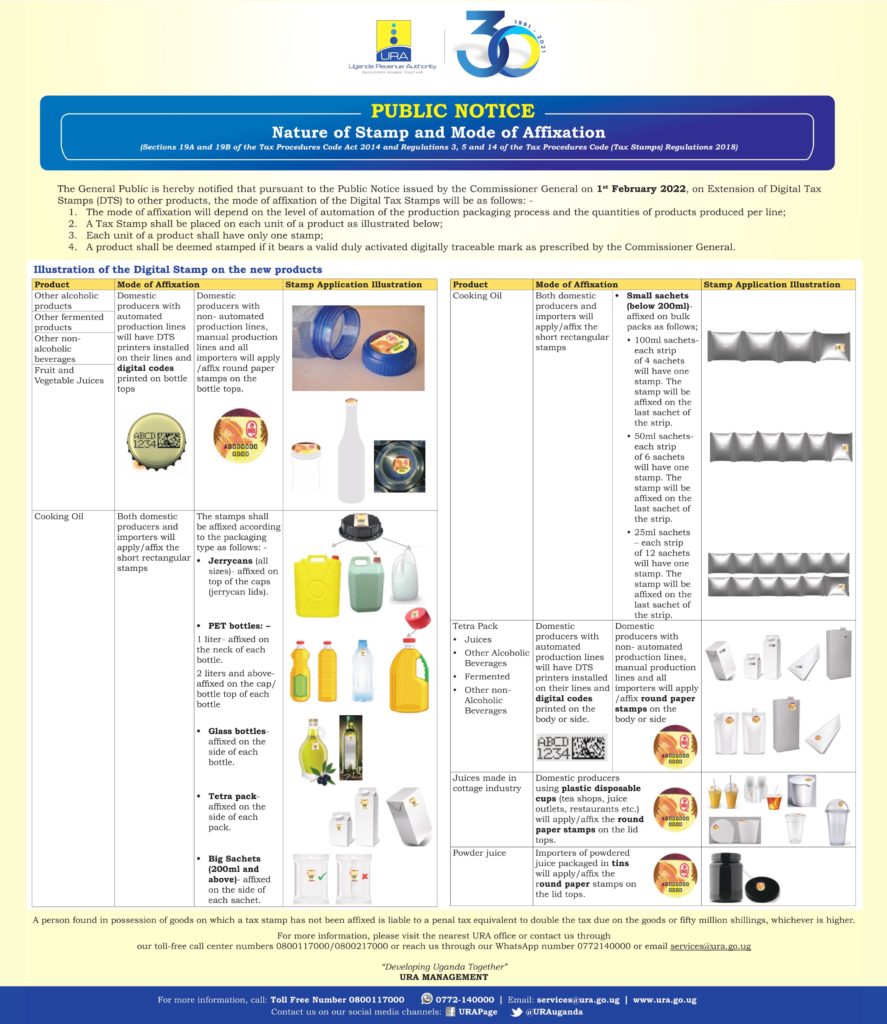

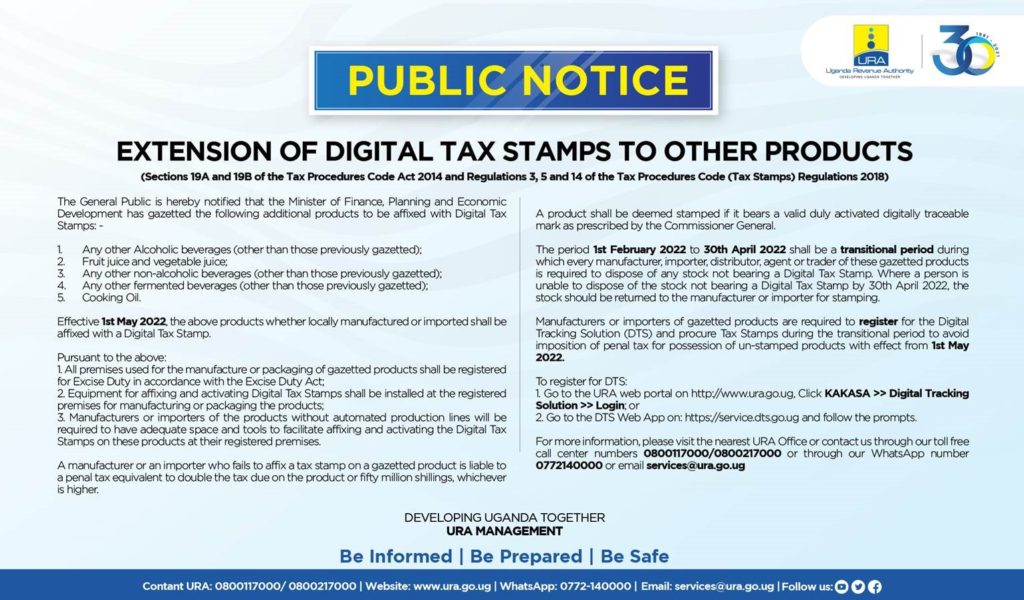

Uganda Revenue Authority has made five more products that will bear digital tax stamps aside of Beer, Soda, Bottled water, Wines, Spirits, Tobacco products, Sugar and cement which were gazetted earlier.

The new products include; cooking oil, juices, alcoholic, non-alcoholic and fermented beverages.

This development is expected to take effect on May, 1st 2022. URA therefore encourages every manufacturer, importer, distributor, agent or trader of these gazetted goods to utilize the transitional period of two months and ensure all stock of gazetted goods bears a Digital Tax Stamp.

For now, URA has started engaging the affected businesspersons for a smooth transition.

Meanwhile, digital tax stamps are unique label applied on packages of products which contain security features and codes to prevent counterfeiting of products and also enable track and trace capabilities.

The system has also helped manufacturers to have more organized records of their production. The Public is able to consume authentic products and protected from consumption of substandard products among other benefits.

Following a directive from the Ministry of Finance Planning and Economic Development (MOFPED), URA started implementation of DTS in November 2019 and has since recorded some achievements.

The DTS register has grown to 538 taxpayers as at 31st December 2021, compared to the initial scope of 107 taxpayers during its roll out. The production volumes and revenue for manufacturers of DTS products grew by 47% and 16% respectively in FY 2021/2022 as compared to the base year 2018/2019.

This financial year, URA is expected to collect UGX 24.6 trillion and one of the key measures highlighted to help achieve this is the implementation of smart business solutions of DTS and Electronic Fiscal Receipting and Invoicing Solution (EFRIS). These solutions are particularly banked to collect Local Excise Duty (LED) and VAT tax heads respectively effectively and efficiently by providing a comprehensive view of businesses and trackability of products on the market.

What does it take for one to have digital stamp? Thanks

Hello Andrew,

One has to be a manufacturer or importer of the products gazetted to bear digital tax stamp.

These products currently include Beer, Soda, Bottled water, Wines, Spirits, Tobacco products, Sugar, cement, cooking oil, juices, alcoholic, non-alcoholic and fermented beverages.