Dismas Nuwaine

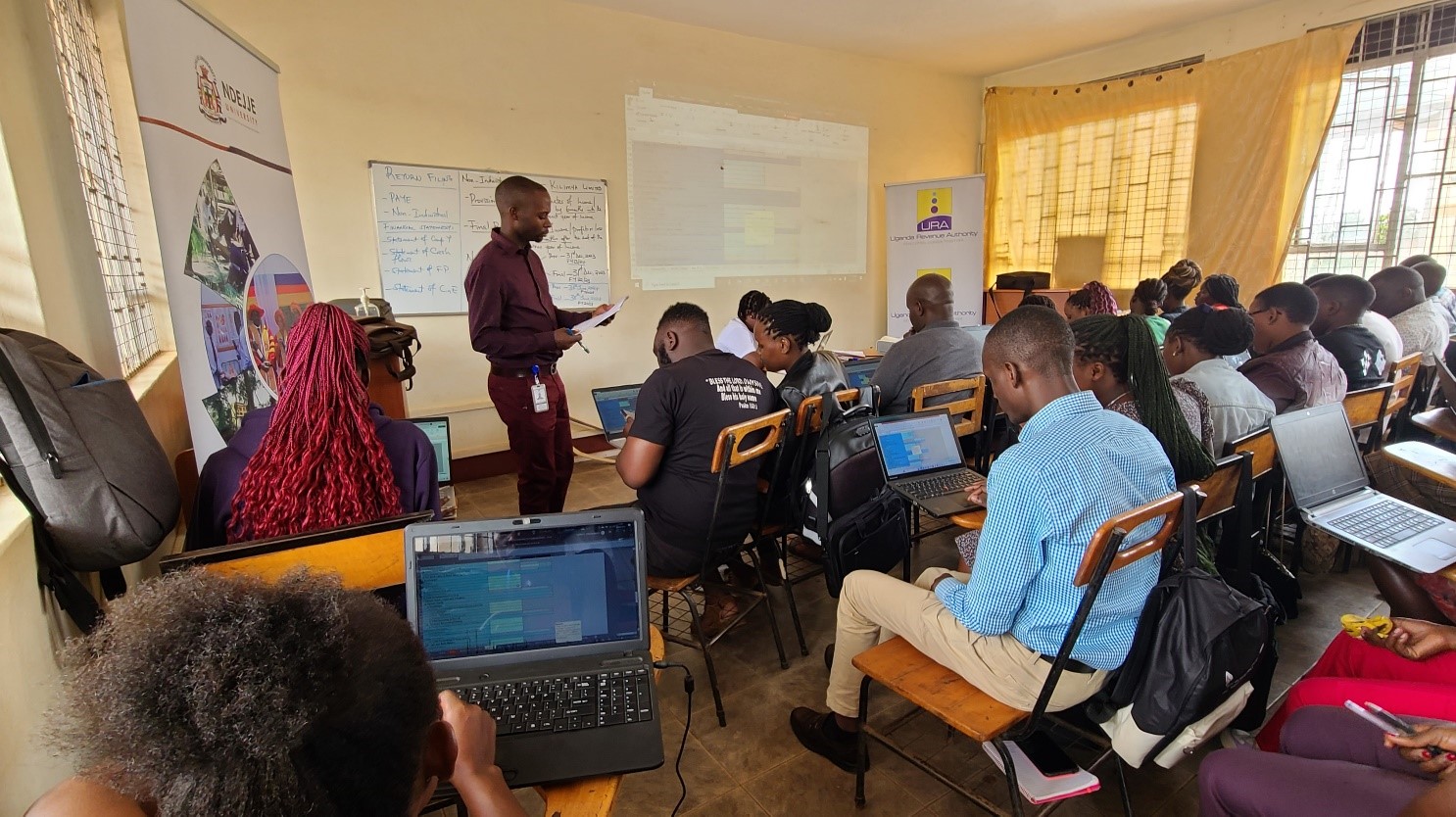

Last week, officials from URA went to Ndejje University where they equipped practical skills in tax to students. They focused on students that have taxation as a course unit.

According to Andrew Kyakonye, the training is aimed at enabling University Tax Society Students acquire valuable hands-on experience in related tax matters while giving back to their communities. Some of these skills include; TIN registration, Income tax returns filing, returns amendment procedures, tax refund qualification among others.

“As URA, we believe that if we close this knowledge gap at the entry level by training these young business-oriented students and channeling them out into the business communities to support Taxpayers, we have hope that we can gradually improve on the voluntary compliance among our Taxpayers,”Kyakonye explained.

Meanwhile, the VITA training program was flagged off in the FY: 2019 / 2020 to encourage students to comply taxpayers to comply voluntarily. The student-oriented program has, to date, upskilled over 5,200 students all over the country. The program has been instituted in most of the major Universities in the country.

These include, but are not limited to, Uganda Christian University (UCU), Kyambogo University, Makerere University, Makerere University Business School, and Kabale University, amongst many others.

At the end of the training, the trainees are assessed and awarded certificates after which, they are flagged off to handhold business communities on their tax obligations.

These trainings are scheduled to continue in Uganda Martyrs University, Kyambogo University and MUBS – Jinja Campus in the subsequent coming weeks.