Kabahweza Kamugisha

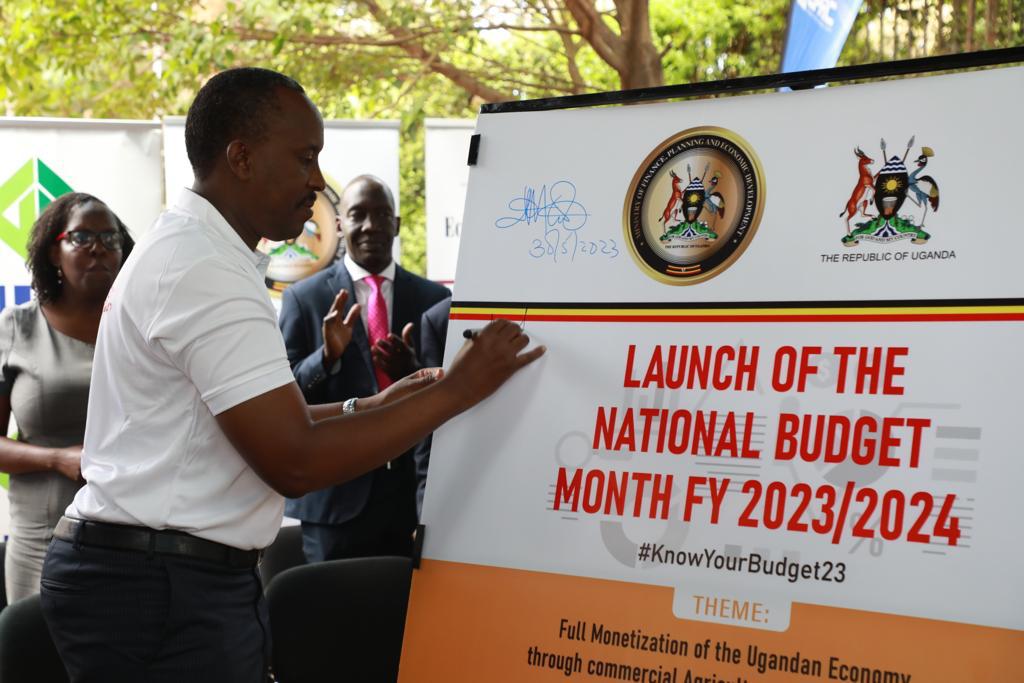

Ministry of Finance Planning and Economic Development, Uganda Revenue Authority and Civil Society Organizations have launched the National Budget Month ahead of the reading of the 2023/24 financial budget.

Speaking before the launch at Uganda Media Centre today morning, URA Commissioner General John R. Musinguzi said that the national budget is a vital tool for achieving Uganda’s development goals as a nation and improving the welfare of the people.

“The national budget is not just a document that outlines government’s expenditure and revenues, but it is a reflection of national priorities and aspirations, and a vital tool for achieving our development goals,” said Musinguzi.

Musinguzi noted that citizens have a right to know what their taxes do, the reason why the engagements are so crucial to share and educate the public about the budget process, solicit feedback and input from various stakeholders and groups, and foster dialogue and consensus on key budget aspects.

“The national budget can only be effective with the active involvement and engagement of the citizens and all economic players because they are the beneficiaries of and contributors to the budget,” he further said.

Launching the National Budget Month, Permanent Secretary and Secretary to the Treasury (PSST), Ramathan Ggoobi, representing Minister Matia Kasaija, said that the objectives of the budget month engagements are to increase public ownership of the national budget, equip Ugandans with all the information about the budget, identify the weaknesses as well as reforms based on evidence from citizens and improve allocation of resources in the national budget for better provision of public service.

“We want to equip Ugandans with all the information about the budget and how to effectively monitor budget execution at all levels of government from the centre up to the village, and the budget is fully open to all Ugandans,” said Ggoobi.

Bank of Uganda official Constance Kibibi Kimuli noted that the central bank is undertaking several strategies to achieve fully monetization on the Ugandan economy that include regulatory reforms, amendment of the Microfinance Deposit-taking Institutions Act, and continued collaboration with Ministry of Finance.

She explained that government has put in place different avenues to support Ugandans recover from the effects of COVID 19 pandemic such as establishing the small business recovery fund (SBRF) and the agriculture credit facility (ACF) to enable businesses and farmers access credit seamlessly.

Both Ggoobi and Musinguzi called on the public to fully utilize the national budget month by attending budget breakfast meetings that will be held across major towns in Uganda in June 2023.