Auction | Cargo Groupage | Warehousing

A Customs bonded warehouse means any warehouse or other place licensed by the Commissioner for the deposit of dutiable goods on which import duty has not been paid and which have been entered to be warehoused.

Warehousing therefore means that imported goods/motor vehicles are deposited for storage in a licensed bonded warehouse with the authority of the person in charge of that warehouse.

- When goods/motor vehicles arrive at the warehouse, they are received by Customs both physically and electronically

- The transit documents from the boarder will always indicate the period within which the goods/motor vehicles are supposed to be delivered at the warehouse and this period must be adhered to

- After electronic receipt (called validation), the documents are handed over to the clearing agent who should be dully appointed by the importer to clear the goods/motor vehicle

The appointed clearing agent makes a declaration for home use (direct payment of taxes) or for warehousing- The declaration must be done within 02 days of arrival at the warehouse of destination

- Goods are verified in the presence of the Importer or the appointed agent or both

A Warehouse keeper is the holder of a Customs license in respect to a bonded warehouse

Note:

- Items are warehousable for a period of six months (180 days), with a period extension of 3months maximum, granted on request. This means that importer should request for the extension if it’s required.

- The only exception to the above are new motor vehicles warehoused by approved motor assemblers and dealers, wines and spirits warehoused in bulk by licensed manufacturers of wines and spirits; and goods in a duty free shop.

- Warehoused goods on permission can be;

| • • • | Transferred to a new owner on payment of USD10 Re-exported to a foreign destination Cleared (paid for) in part | • • • | Removed from one warehouse to another Re-packaged Temporarily removed for repairs or modification (in case of vehicles) where applicable. A security in form of bank draft covering the taxes payable is deposited with Customs. |

- The following goods are not warehousable

| • • • | Acids for trade and business; Ammunition for trade and business; Arms for trade and business Chalk Explosives Fireworks | • • • | Dried fish Perishable goods Combustible or inflammable goods except petroleum products for storage in approved places |

| • | Matches other than safety matches | ||

| • | Any other goods which the Commissioner may gazette |

- Once goods exceed the mandatory warehousing period, they are tagged for auction. However, the owner can redeem them by paying 1% of the value if they have not been advertised for sale or 3% of the value if they have been advertised.

- Goods that are advertised in the category above are sold by Customs through a public auction.

- The importer delivers goods to the Consolidator of his/her choice (Shipper) in the foreign country (eg. China, UAE) together with all the documents showing the nature of the packages, description of the items as well as the invoices, packing list

- When goods arrive at the port in the Partner State (eg. Mombasa, Dar-esSalaam), transit entries are captured to move the goods to the destination bond in Uganda, where final clearance will take place. These Customs documents are called WT8 and T1

- When the Container arrives in the ICD/Bond and the Customs officer has duly received it, the registered consolidator now de-groups (breaks bulk) by splitting all the cargo and will be required to obtain house bills of lading for every individual importer to handle their own clearances

- All individual importers should have TINS and will be require to appoint their own licensed Customs agents to take on the process of clearing the items

- The consolidator is to ensure that before the goods arrive in Mombasa/Dar-esSalaam, all individual importers in the container have been IDENTIFIED; have TINs and have submitted the required purchase documentation i.e. invoices, evidence of payments, parking lists with detailed description of goods, quantities, delivery notes etc

- The individual importers have an option of either warehousing the goods (IM7) or pay taxes (IM4). All the purchase documents (invoices, evidence of payments, parking lists with detailed description of goods, quantities, delivery notes etc.) must be declared to Customs at this point

- Where the clients are not available, the warehousing entry (IM7) will be captured in the names of the consolidator

- Where individual importers have appointed their Customs agents; declarations shall be made within two days from the date of appointment, lest the consolidator can go ahead and warehouse the goods to avoid un-necessary delays

- The container will be de-stuffed only when all the individual declarations have been made

Customs warehouse” means any place approved by the Commissioner for the deposit of unaccounted for goods, unexamined, abandoned, detained, or seized, goods for safe custody. If such goods are not claimed and redeemed, they are disposed off as the Commissioner may decide.

Note:

- A list of goods in the categories mentioned above is generated and publicized for a period of 30 days

- Customs allocates lot numbers (Identification numbers) for easy identification by the prospective buyers

- Owners of such goods (the category that is redeemable) are given 30 days from the date of publication within which they can redeem their goods and pay the FULL taxes

- The exercise of auction is conducted through online bidding

- Clients are encouraged to view the lotted items, before the day of auction

- Successful bidders are required to pay 25% of the bid amount and this is paid instantly on being declared winner.

- The balance of 75% is payable in 48 hours and failure to comply with this leads to cancellation of that bid/sale, and the bid lapses and goes onto the next sale.

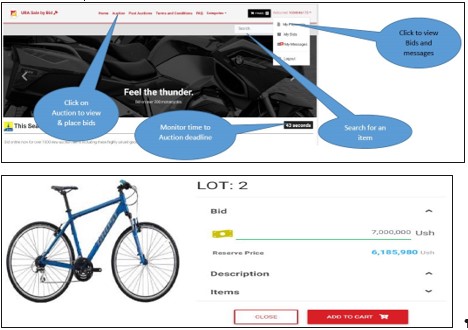

The Online Auction site can be accessed through http://singlewindow.go.ug/auction/ home

- On the home page, the participant should click on auction to navigate through the available auction lots and click on view for more details.

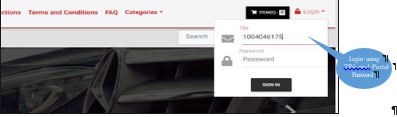

- Bidder is required to login using his URA portal account details (TIN and Password) in order to participate in the bidding process

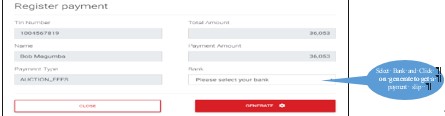

- A payment registration slip will pop up to enable the auction participant select his preferred Bank and create a payment registration slip to enable him/her pay for the participation fee

- Once the payment is reconciled, the bidder will log into the website again to have more options.