By Niyonshima Joshua and Photography by Irene Kabakama, Media Management

The Commissioners General of East African Revenue Authorities in the recently concluded 50th meeting resolved to have a harmonized EAC Regional Domestic Taxes Department system and policy.

This is to explore the tax contribution of the agricultural sector, harmonize data governance policies, adopt the use of drone technology, and protect territorial integrity while using smart gate technology in streamlining efficiency. This was premised on tax decisions in the second publication of the East African Community Tax Law Reports for the period 2019-2021.

During the meeting, participants appreciated the implementation of previous resolutions across the revenue authorities and entreated for continuance in accomplishing ongoing and new resolutions.

The forum committed to taxation of the digital economy and tasked the Kenya Revenue Authority to convene a virtual engagement to empower other revenue authorities on the legal framework and implementation of the Digital Service Tax (DST). It was further agreed in the meeting to engage the respective governments to promptly implement a uniform DST rate of 5% across the region.

“Digital service providers like Amazon are earning big from our economies with a small or no revenue contribution, it is high time we tapped into this platform. More so Kenya has taken lead hence the need to follow suit,” remarked Rujoki Musinguzi.

Other matters conferred included the need to collaborate on enforcement and revenue collection operations, the development of legal frameworks and modalities on tax crimes, recovery of tax arrears and use of technology in tax administration across the revenue authorities.

“Harmonization will give us the advantage of promoting our region as a destination of choice for investment hence improving our joint gross domestic product and enhancing our tax revenues,” said Ramathan Ggoobi, the Permanent Secretary Ministry of Finance Planning and Economic Development and Secretary to Treasury.

Ggoobi also encouraged all revenue administrators in the region to promote this partnership under the EARACGs forum and actively work towards strengthening its influence on tax policy and administration issues in the region.

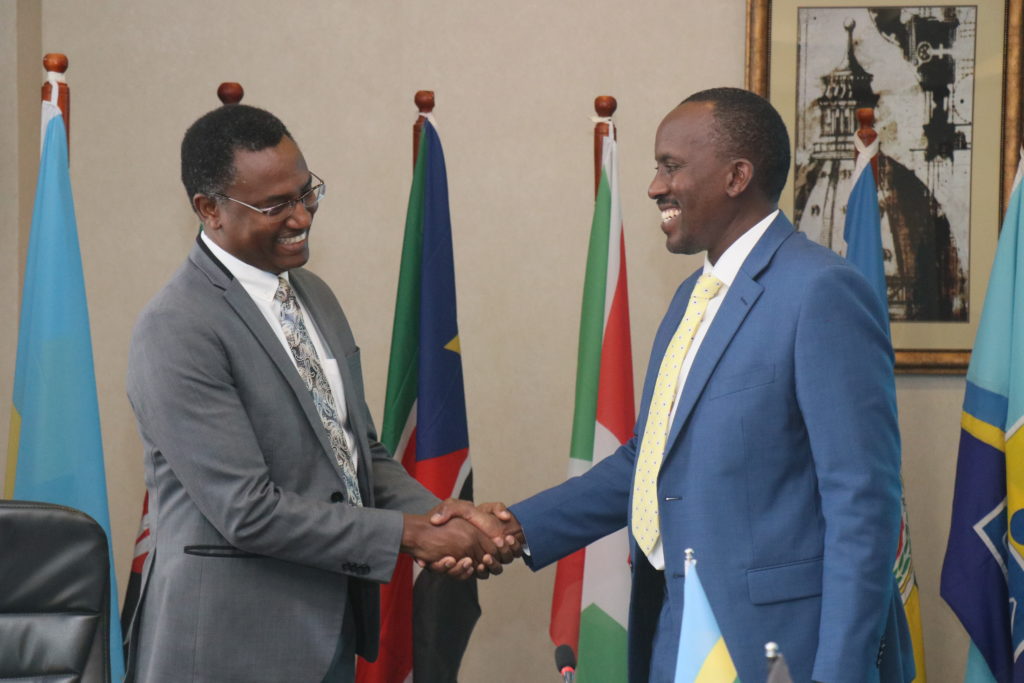

The Commissioners General meeting is a bi-annual event with the objective of sharing experiences and addressing common challenges facing tax administrations in the region.

It was attended by members of the Uganda Revenue Authority, Burundais des Recettes (OBR), Kenya Revenue Authority (KRA), Rwanda Revenue Authority (RRA), Tanzania Revenue Authority (TRA), South Sudan National Revenue Authority (NRA), Uganda Revenue Authority (URA), and Zanzibar Revenue Authority (ZRA) and representatives from the East African Community (EAC) Secretariat.