Non-Tax Revenue Non-Tax Revenue (NTR) is the recurring income earned by the government from sources other than taxes. NTR fees were previously collected by the various Ministries, Departments and Agencies (MDAs), later Ministry of Finance (MOFPED) gave URA the mandate to collect all NonTax Revenue fees and to account for the fees Collected.

Please note:

URA DOES NOT provide Non-Tax Revenue services but simply facilitates the payment registration process. For the actual services, please contact the relevant Service Providers.

- To facilitate the collection of all Non-Tax Revenue fees.

2. To account for the collected NTR revenues to the respective stakeholders. URA developed ETAX interface with the various MDAs. The MDAs are in position to reconcile paid assessments (registered PRNs on the URA Web portal that are paid).

Role of MDAs in the administration of NTR

The MDAs have the mandate of assessing the NTR fees on the various items under them.

MDAs Involved in NTR

Some of the MDAs currently involved in the administration of NTR include but are not limited to:

• Ministry of Works who assess fees on: Driving licenses under the Uganda Driving Licensing System Project (UDLS), construction standards and quality, motor vehicle registration i.e. change of ownership fees, alteration fees, de-registration fees, reregistration fees, duplicate document fees, form fees and caveat management fees, among other items.

• Ministry of Internal Affairs who assess fees on: Passport fees, work Permits, Special Pass Fees, Certificate of Residence, Penalty for Illegal Stay, Pupils Passes Fees, Blasting (Quarry) Permits, NGO Registration, Tenders (MOIA), Water Sample (e.g. after rape), Appeal Fees, Registration of Foreigners, DNA analysis among others.

• Police Department: who assess fees on: Firearms, Tenders, Express Penalty among other items.

• National Identification and Registration Authority (NIRA) who assess fees on: Identification cards, Birth & deaths among others.

• Ministry of Lands who assess fees on: Registration of titles, Lease and Letters of administration among other items.

The process involves generating a payment registration slip for the service you want from the URA website. You will then proceed to pay the required amount using your preferred platform; the system supports paying with a debit/credit card, in a bank, via Pay Way, and mobile money.

How to generate a payment registration slip

- In a browser, visit the URA website at: https://www.ura.go.ug.

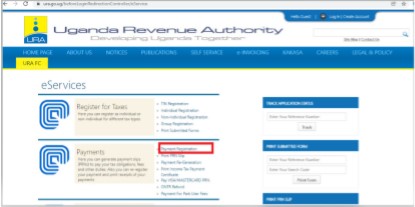

2. While still at the homepage, click on eservices.

3. On the eservices page, under Payments, click on Payment Registration

4. For driving licenses; on the payment registration page, under the Tax Head section, select NTR and fill in the taxpayer details.

Then under Details of NTR section, select your preferred Driving license category / NTR Head.

5. For Other-NTR; on the payment registration page, under the Tax Head section, select other- NTR and fill in the taxpayer details.

Then under Details of Other- NTR payments section, select the Government Ministry/ Department /Agency to which the payment you want to make falls.

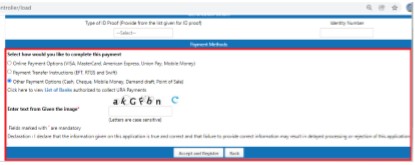

6. Having selected your preferred NTR or other- NTR; at the bottom, select your preferred payment option.

7. When you are done with filling the payment registration form, click accept and register.

8. Download and print the form. With the printed form, you can go ahead and pay with a debit/credit card or in a bank or via Pay Way or mobile money.

NTR fees in foreign currency

Where the applicable NTR fees are in foreign currency, the NTR fees applicable, in Uganda shillings is computed as the product of the amount in foreign currency and the exchange rate (daily rate).

Non Tax Revenue Refund

This is a process where a taxpayer claims money that was paid in excess or error at payment registration as fees collected by URA on behalf of other Government Ministries/ Departments/Agencies. The taxpayer is supposed to show evidence of payment of such funds, e.g. the payment registration slip.

Please note: The processing of the NTR refund shall only commence after submission of the necessary information within the timelines.

The refund process is manual.

Apply for a refund by downloading Form DT-3008 (visit the URA website, click on download manual forms<> domestic folder<> refund folder), print out and then manually fill it and deliver it to your tax office with the attached proof of payment.