A Customs agent is a person who has been licensed by the Commissioner Customs to facilitate smooth declaration and or clearance of goods in or out of the country on behalf of another person.

The East African Community Customs Management Act (EACCMA) provides that the owner of any goods entering or leaving the country is required to seek services of an authorized agent.

Clearing agents are mandated to provide professional services of tax declaration to importers and exporters. Uganda Revenue Authority [URA] deals with accredited clearing firms represented by agents. Taxpayers are however not supposed to leave all their tax affairs in the hands of agents and should keep a close look at what agents do.

You are advised to always seek guidance on a cross range of tax matters through the information library found on the website; www.ura.go.ug.

These among others include:

• Acquire an authorization letter from the owner of goods

• Obtain import/export documents (e.g. original import documents – bill of lading, invoice or parking list or any other documents that relate to the importation or exportation of goods).

• Go to the bonded warehouse or the border stations where the goods

are and process transit or import documents for final clearance.

• Provide, whenever required by customs administration, an authorization form from the firms or persons by whom he is employed to act as their customs agent;

• Represent a client in any matter related to customs;

• Advise a client against non-compliance to customs laws.

• Exercise due diligence to ascertain the correctness of any information which he imparts to a client with reference to any customs operations.

• Not withhold information relating to customs operations from a client who is entitled to such information.

• Together with the importer, promptly pay government any duties, taxes or other debts and promptly account to his clients for any money received for them from government.

NB Importers should never hand over the payment obligation for taxes exclusively to the clearing agents. Payments should either be made by cheque to URA or cash deposits to the bank.

Clearing agents are also expected to:

• Not attempt to influence the conduct of any officer of customs in any matter pending before customs by the use of threat, false accusation, duress or the offer of any special inducement or promise of advantage, or of any gift.

• Not procure or attempt to procure, directly or indirectly, information from customs records or other government sources of any kind to

3

which access is not granted.

• Inform the customs administration of any change of address before such a change is effected.

• All licensed Agents have a license Certificate displayed in their offices

• One can find the list of all licensed Clearing Agent firms on the URA

website or single window

• All Clearing Agents are required be in their company uniforms (clearly indicating company name) while on duty at the border or in the bonded warehouses.

Visit any URA office for guidance if in doubt of any that offer their services.

Yes, Customs agents must be licensed by the Commissioner before they can be involved in the clearance of goods through Customs. An application on Form C20 must be made and presented to the Commissioner for consideration. And in this case, the application is done.

No, the Commissioner can only license people/companies who are registered, knowledgeable about Customs clearance and have an office with equipment like computers. Licenses will not be issued or renewed if the licensee or applicant has a criminal record, is involved in dishonest activities or any other wrong doing.

The validity period of a Customs Agent license is 1 calendar year. Licenses obtained in the course of the year all expire on the 31st December of every year.

No, the renewal is subject to the Commissioners approval based on considerations like: all queries have been answered and no major offenses have been committed.

Only Authorized Economic operators are given automatic renewal as part of

benefits for the compliance.

Yes, there is an application fee of US$ 50 and an annual license fee of US$ 400.00

The owner of goods being cleared through Customs is responsible for what the authorized agent does during the period he/she is acting on his/her behalf. Both the owner and the agent will be prosecuted for any unlawful acts done in regard to the goods.

An agent should notify the Commissioner that he intends to act on behalf of the various clients who have authorized him to do so.

The client must provide to the agent with the relevant documents in unaltered state and equip the agent with a true and correct position to avoid misrepresentation.

a) Submission of duly completed application form (C.20) after payment of application fee of US$ 50 (Fifty dollars);

b) Must have an office with sufficient equipment with the following ASYCUDA World System End User Specifications;

c) The physical location/address must be indicated in the application

form for verification;

d) Certificate of Incorporation, company Form 7 or Form 20, Memorandum

and articles of association should be attached on the application

e) The applicant must be tax compliant in all tax heads, i.e. corporation tax, VAT and income tax for the company itself, the directors, shareholders and employees; a tax clearance certificate is required;

f) The applicant must provide a sample of the original company/firm

headed letter and stamp impression;

g) Shareholders, Directors and employees must not have an interest in

more than one clearing company/firm;

h) Particulars of the bank account/s must be indicated on the application form;

i) Recent passport sized photographs of directors and staff duly certified

by a Notary Public or a Commissioner for Oaths should be attached;

j) A minimum of two employees in charge of clearing of goods in Customs should be in possession of a diploma or certificate in customs clearing & forwarding from a recognized institute/EACFFPC for purposes of transacting business;

Evidence of their employment contract and compliance with all statutory obligations is required

k) Proof of affiliation or membership of a RECOGNIZED clearing &

forwarding association;

l) A valid tenancy agreement with stamp duty duly paid, for suitable office accommodation valid up to 31st December 2018 or proof of ownership of office accommodation;

m) Payment of license fee of US $400 (four hundred dollars) on approval of application;

n) There will be no handling of transit (inward, outward and transit through) unless after presentation of a bank guarantee and demonstration of the companies’ financial capability to handle such consignments at entry/exit points;

o) Practical and written competence assessments will be conducted for the declaration staff of the company on Customs matters; Passwords will be issued to those who successfully pass the assessments. Companies whose declarants fail the Competence assessments will not be licensed.

5

p) All licensed companies shall be subjected to performance measurement (KPIs) to assess efficiency in service delivery and compliance to Customs laws on a monthly basis. Annual performance rewards shall be granted to the best performing firms and those who fall below minimum expectations will be relegated.

q) Any Company involved in any fraudulent Act against Customs Laws and Procedures shall have its license suspended and or revoked.

r) The Company performance score (KPIs) will form part of eligibility for licensing.

s) The companies shall have no outstanding transactions dating as far

back as 30th June 2017.

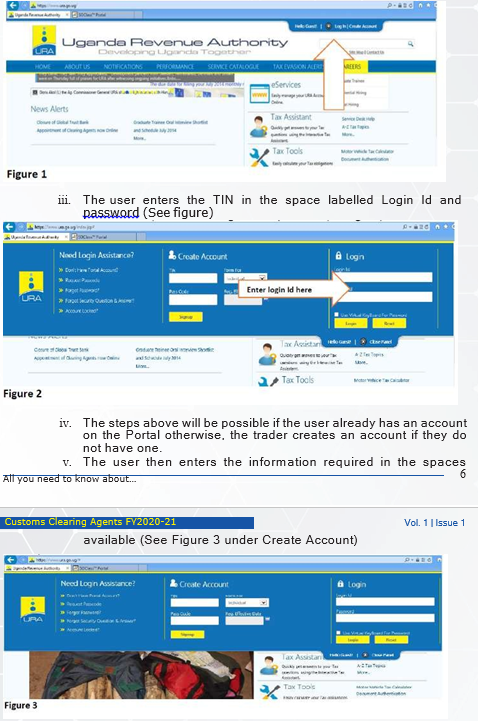

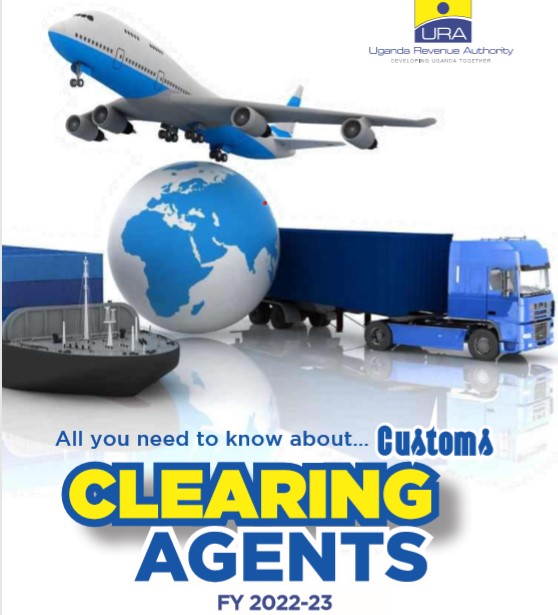

i. Enter URA link https://www.ura.go.ug in the Address bar to access the URA Portal.

ii. The user shall click the Login option (See figure 1) to open the

login options.