By Kamugisha Kabahweza

The Association for youths with hearing impairment has asked Uganda Revenue

to develop and produce tax information designed to meet their hearing needs. This call came during an engagement between URA officers and Makerere University Association for the Deaf Students (MUKADS) that was held at the URA tower in Nakawa on Thursday 10th November 2022. They explained that it is so hard for them to understand tax information which is posted online when they do not hear anything.

The theme for the engagement was ‘An inclusive tax regime for persons with hearing impairment – Deaf.’

The youth were speaking through interpreters Micheal Emong and Olivia Nakigozi. The engagement came after the International Deaf Awareness Week that was held in Iganga where URA participated in September 2022.

URA Tax Education Officer Andrew Kyakonye noted that the tax body needs to understand tax needs for the Deaf in order to better serve them and build a relationship that fosters voluntary compliance. He explained that URA is engaging the youths, who are majorly involved in Small and Medium Enterprises (SME’s), because they make up the biggest percentage of Uganda’s population.

The stakeholders agreed to guide URA on developing and producing tax information for the deaf, reviewing URA’s structure to cater for Persons with Disability (PWDs), and build capacity building programs specifically for PWDs.

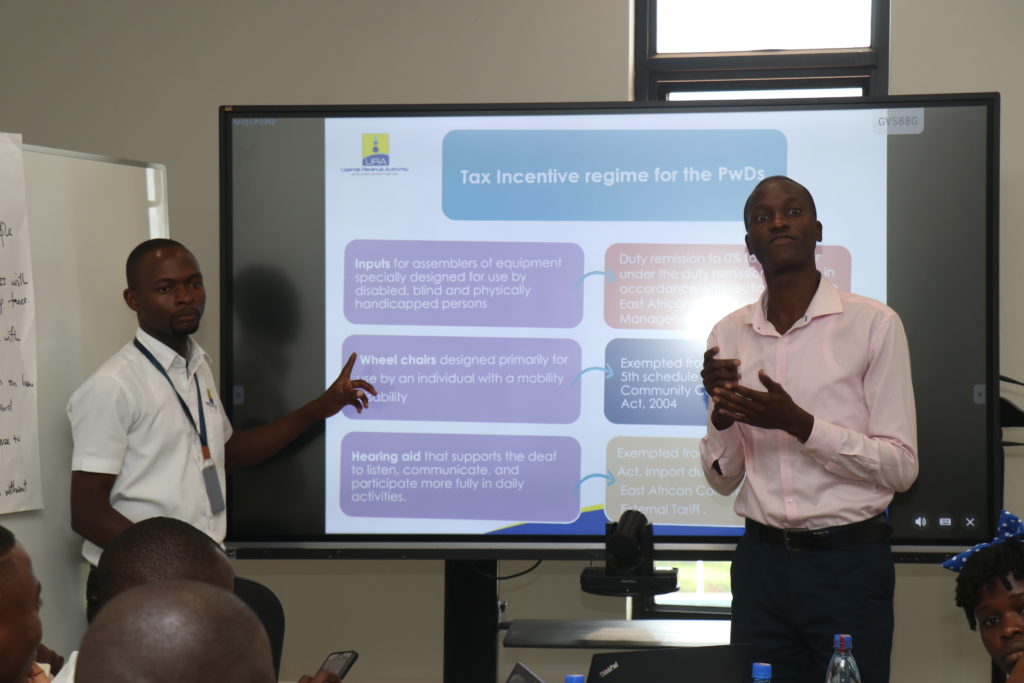

On the issue of tax exemptions for the Deaf, URA advised them to write a proposal through their organization and parliamentary representatives, seeking amendments in taxation laws and present it in parliament. He explained that URA has three mandates namely to collect and account for tax and non-tax revenue, administer and enforce tax laws, and advise government on tax policy.

Kyakonye enlightened the deaf on different tax heads in income tax such as PAYE, WHT, Corporation Tax, Rental Tax, Individual Income Tax, Presumptive Tax and Capital Gains. He also took them through the process of generating a TIN using the online registration form on the URA web portal.

The deaf, led by Alex Ogwal, appreciated the engagement noting that URA is fair in administering and enforcing tax laws than they had earlier thought.

Ag. Supervisor Tax Education Outreach, Isaac Gyagenda, told the hearing impaired youths that URA introduced self-assessment which has increased voluntary compliance.