In 1925, the petroleum potential of Uganda was documented by a Government Geologist

E.J. Wayland, in the publication “Petroleum in Uganda”. The report documented the existence of oil seepages along the shores of Lake Albert on both the Uganda and the Democratic Republic of Congo sides of the lake. This was followed by a series of explorations and in 2006, Hardman Petroleum Pty (now Tullow) made the first commercial discovery in the Kaiso Tonya area. Currently Uganda has approximately

6.5 billion barrels of oil reserves, with at least 1.4-1.7billion barrels estimated to be economically recoverable.

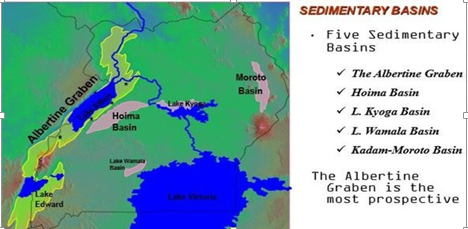

Uganda has five sedimentary basins i.e. the Albertine Graben, Hoima Basin, lake Kyoga basin, Lake Wamala Basin and Kadam-Moroto basin.

The Albertine Graben is the most oil and gas prospective basin and 85% of which is still unlicensed.

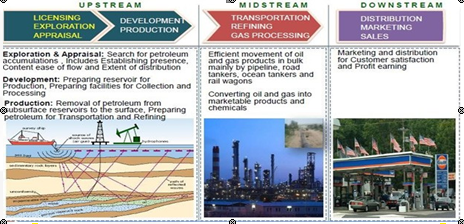

The petroleum value chain is made up of upstream, Midstream and Downstream

Upstream- involves Acquisition, Exploration, Appraisal, Development, Production and Decommissioning of the crude oil projects.

Midstream- involves transportation of Crude (Pipeline), Refinery, gas processing and

Conversion.

Downstream- involves distribution, marketing and sales of the refined products

The oil and gas fields, whose resource potential has been evaluated include Kingfisher, Mputa, Waraga, Nzizi, Kasamene, Kigogole, Nsoga, Wahrindi, Ngara, Ngege, Ngiri, Jobi- Rii, Gunya, all of which are under production licenses. This is in addition to Mpyo and Jobi East which are under appraisal awaiting award of a production license.

The recent conclusion of key oil

and gas agreements (HGA, SHA & TTA) unlocked significant investment into Uganda’s economy. These include the implementation of the Tilenga Project in Buliisa and Nwoya districts and the Kingfisher Project in Hoima and Kikuube Districts with an expected CAPEX of USD 6-8 billion.

This is in addition to what Government

is already investing in the required support infrastructure, including Hoima International Airport(overUSD500m)and700kilometres

of oil roads (approx. USD900m).

In furtherance of the exploration activities in the Albertine Graben, the first licensing round was launched and the Government of Uganda signed three Production Sharing Agreements (PSA) in September/October 2017 and thereafter issued:

• One License for Petroleum Exploration, Development and Production over the Kanywataba Contract Area to Armour Energy Limited (AEL) from Australia.

• Two Licenses for Petroleum Exploration, Development and Production over the Ngassa Shallow and Ngassa Deep Contract Areas to Oranto Petroleum Limited from Nigeria.

Following

The oil and gas fields, whose resource potential has been evaluated include Kingfisher, Mputa, Waraga, Nzizi, Kasamene, Kigogole, Nsoga, Wahrindi, Ngara, Ngege, Ngiri, Jobi- Rii, Gunya, all of which are under production licenses. This is in addition to Mpyo and Jobi East which are under appraisal awaiting award of a production license.

The recent conclusion of key oil

and gas agreements (HGA, SHA & TTA) unlocked significant investment into Uganda’s economy. These include the implementation of the Tilenga Project in Buliisa and Nwoya districts and the Kingfisher Project in Hoima and Kikuube Districts with an expected CAPEX of USD 6-8 billion.

This is in addition to what Government

is already investing in the required support infrastructure, including Hoima International Airport(overUSD500m)and700kilometres

of oil roads (approx. USD900m).

In furtherance of the exploration activities in the Albertine Graben, the first licensing round was launched and the Government of Uganda signed three Production Sharing Agreements (PSA) in September/October 2017 and thereafter issued:

• One License for Petroleum Exploration, Development and Production over the Kanywataba Contract Area to Armour Energy Limited (AEL) from Australia.

• Two Licenses for Petroleum Exploration, Development and Production over the Ngassa Shallow and Ngassa Deep Contract Areas to Oranto Petroleum Limited from Nigeria.

Following Cabinet approval, the Minister, MEMD launched the second licensing round for petroleum exploration at the 9th East African Petroleum Conference and Exhibition in Mombasa, Kenya during May 2019. This licensing round covers five blocks in the Albertine Graben and is underway.

Cabinet approval, the Minister, MEMD launched the second licensing round for petroleum exploration at the 9th East African Petroleum Conference and Exhibition in Mombasa, Kenya during May 2019. This licensing round covers five blocks in the Albertine Graben and is underway.

i) The EACOP Project

The EACOP project will traverse 10 districts in Uganda and 14 districts in Tanzania. A 1,445km long, 24-inch diameter, buried and heated EACOP from Kabaale, Hoima in Uganda to Chongoleani in Tanga, Tanzania, is to be developed to transport crude oil from Uganda to Tanga port in Tanzania. The pipeline will have a loading pad in Kabaale, six pumping stations and 27 heating stations along the route together with a facility to load crude oil onto the tankers at Chongoleani

The EACOP Capital Expenditure has been optimized at USD 3.55bn.

The EACOP project will be a partnership between the Governments of Uganda (represented by UNOC) and Tanzania (represented by TPDC), together with the Total E&P Uganda B.V and CNOOC (Uganda) Limited. The EACOP will be funded through project financing.

ii) The oil refinery Project: The East African Community (EAC) Refineries Strategy of 2008 recommended, among other things, the development of a second refinery in East Africa to be developed in Uganda. The other refinery being that of Mombasa which has since been shut down. Uganda’s Refinery involves the development of a greenfield oil refinery, with a capacity of 60,000bpd in Uganda, and the associated downstream infrastructure.

The Refinery project will be a private

sector led project, with Government’s share held by the Uganda National Oil Company, through its subsidiary Uganda Refinery Holding Company. East African Community partner states (Kenya and Rwanda) and Total E&P Uganda B.V have expressed interest in holding shares. The project will be funded through a debt to equity ratio of about 70:30. The Lead Investor will be responsible for raising the debt for the project.

The Uganda Refinery project, which includes development of 211-kilometre petroleum products pipeline from Hoima to the North West of Kampala, has an estimated CAPEX of USD 3.5 – 4 billion. The Uganda Refinery Project is expected to take the Final Investment Decision (FID) by February 2022.

i) Kampala Storage Terminal (KST)

300 acres of land have been secured for the development of KST. The Terminal will be a hub for all envisaged (inland and trans boundary) pipelines for refined products in/through Uganda. The terminal will further enhance reserves of petroleum supply in the country. Its CAPEX is estimated at USD 152M. KST is a downstream project and therefore out of scope of the mandate of PD which was established to manage the upstream and midstream. However, it has essential linkages with the refinery project and may need to be managed by PD for better effectiveness.

ii) Kabaale Industrial Park (KIP)

The Government of Uganda acquired land (29.57 sq.km) to develop an oil and gas industrial park in Kabaale, Hoima District.

The park will comprise of Uganda’s 2nd international Airport, Crude Oil Export Hub,

Uganda Refinery and petrochemical & Fertilizer industries among others.

The following statutory bodies regulate the activities of the petroleum sector in Uganda;

Ministry of Energy and Mineral Development – policy formulation, investment promotion and licensing.

Petroleum Authority of Uganda (PAU) – regulation and monitoring of upstream and midstream sub-sectors and ensuring compliance with the law

Uganda National Oil Company (UNOC) – This is the commercial arm of government’s interests.

Ministry of Finance, Planning and Economic Development– responsible for the fiscal

aspects of the industry.

Uganda Revenue Authority (URA) – has the mandate to assess, collect and administer petroleum revenues.

Corporation Income Tax (CIT) at 30%;

WHT for service providers to licensees – 10%;

WHT applicable to local providers – 6%;

WHT on interest and dividends – 15%;

Branch Profit Tax (BPT) – 15%;

VAT – 18%;

Import duties – vary from 0% to 25%.

The Government of Uganda has continued to promote foreign investment in oil and gas and other sectors through the Uganda Investment Authority (UIA), the

Presidential Investors Round Table (PIRT) and by minimizing macro-economic policy

shifts, which render undertaking business in Uganda more predictable.

Uganda has a friendly investment policy framework aimed at attracting investments, and one way this is done is through the policy of provision of tax incentives to investors.

| S/N | TAX INCENTIVE | DESCRIPTION | APPLICABLE TAX LAW |

| 1 | Import duty exemption on Equipment and inputs used in oil and gas | Equipment, inputs and goods for direct and exclusive use in oil and gas or geothermal exploration and development, except motor vehicles | The 5th Schedule of the East African Community Customs Management Act (EACCMA), upon recommendation by the Competent Authority |

| 2 | Reduced WHT rate on non- resident contractor payments. | WHT on non-resident contractors providing services in the oil and gas is reduced to; 1) 10% on gross payment for upstream field services; 2) 5% for the EACOP project for provision of professional and other services. NB. In other businesses, WHT on non-resident service fees payments is at the rate of 15% | The Income Tax Act and per the Agreed Fiscal Regime under the HGA, contained in the EACOP (Special Provisions) Bill. |

| 3 | Exemption from 6% local WHT | Tax complaint taxpayers may be exempted from 6% WHT | The ITA Section 119(5)(f) |

| 4 | Deemed VAT provisions | In order to incentivize the oil and Gas sector, the VAT deeming position was introduced in Uganda in effective July 2015. Under this provision of the VATA, VAT charged by the contractor to the Licensee is deemed paid and therefore the contractor is not required to pay this VAT to URA. | The VAT Act Section 24(5). |

| 5 | VAT Cash refunds | Contractors who purchase supplies incur input VAT. This has to be refunded efficiently by URA to ease taxpayers’ cashflows. | VAT Act Section 42(1): Refund of overpaid tax |

| 6 | Credit for VAT input tax on imported services | Generally imported services other than exempt services made by a person are charged to VAT at the rate of 18%. However, for Licensees and contractors in oil and gas a credit for input tax is allowed on import of services. The effect is that the licensee or contractor ultimately pays Zero VAT on imported services. | VAT Act Section 28(1)(b): credit for input tax is allowed on all imports of services made by a contractor or licensee during the tax period. |

| 7 | Uncapped carry forward losses for contractor and subcontractor | Section 89GA (2) and (3) of the ITA Section 38 of the ITA for other businesses | |

| 8 | Accelerated capital deductions | Sections 89GB, 89GC and 89GD |

| SN | TAX INCENTIVE |

| INCOME TAX |

| 10-year corporate income tax exemption for the Project Company; | |

| WHT on interest payments to related finance parties – rate of 10% reduced from the standard 15%; | |

| WHT on interest payments to independent finance parties – 0%, as opposed to the standard 15%; | |

| WHT due on payments to non-residents for technical and other services – rate of 5% as opposed to the standard 15%; | |

| No WHT to be imposed on the import of goods for the direct and exclusive use of the EACOP Project; | |

| No WHT on payments or deemed payments of dividends by the Project Company. Usual tax imposed on dividends is WHT at the rate of 15%; |

| VALUE ADDED TAX |

| Right to VAT registration, and applications for VAT registration are not to be unreasonably rejected; | |

| No VAT on the supply of transportation and incidental services through the EACOP system by the project company; | |

| No VAT on the import of goods and services for the direct and exclusive use by the EACOP Project; | |

| No VAT on the import, sale for export or export of petroleum; | |

| VAT Deemed paid provisions apply to supplies made by Level 2 Contractors to level 1 Contractors; | |

| VAT Deemed paid provisions apply to supplies made by a Level 1 Contractor to the Project Company. | |

VAT cash refunds for VAT paid by Level 2 contractors on local purchases |

| IMPORT DUTIES/ CUSTOMS DUTIES AND EXCISE DUTIES |

| Supplies to the EACOP Project are never to incur Excise duties (these are not to be a cost to the project); | |

| No customs and import duties to be imposed on machinery, other inputs and temporary importation of motor vehicles for the direct use of the EACOP Project; | |

| No customs and import duties, African Union Levy or EAC infrastructure levy to be imposed on capital goods for direct and exclusive use for the EACOP Project; | |

| No duty, processing fee, security or bond to be provided or paid for temporary imports by the EACOP Project; | |

| No security to be provided for the import or sale for export of petroleum. |

| STAMP DUTY |

| A Stamp duty exemption for transfer of shares in the Project Company; | |

| Instruments for grant, conveyance, transfer or other land acquisition – Stamp Duty to be limited to 10,000 UGX (normal rates per instrument usually range from 0.5%-1% of the Value); | |

| Instruments effecting the transfer, novation, assignment or sub-participation of any interest of a finance party in a financing agreement- limited to 10,000 UGX. (normal rates per instrument ranges between 0.5% to 1% of the Value). |

| OTHERS LEVIES |

| No transit fees, taxes or other charges to be paid for the transportation of petroleum through the EACOP System; | |

| A cap applies to all other charges (e.g. local government rates, trade license fees, investment license fees, fees for renewal of project authorizations). Capped to 100,000 USD per annum |

• The Petroleum Division under the Domestic Taxes department is equipped with knowledgeable trained staff to focus on tax administration for oil and gas companies (Licensees) and major industry contractors;

• The Authorized Economic Operator (AEO) status is granted to compliant

Taxpayers, enabling them to qualify for WHT exemption, Pre-arrival clearance of imports, automatic renewal of license etc.

• A dedicated desk in URA to fast track and expedite EACOP transactions and

efficiently process VAT refunds;

• Improving the online platform for tax payments including VISA and Master Card payments , recording transactions and submission of tax returns (eTax and EFRIS);

• Introduction of the voluntary disclosure initiative: where penalties and interest

are waived for taxpayers who come out voluntarily to declare inadequacies in their tax compliance duties without being prompted by any URA action;

• Introduction of the Alternative Dispute Resolution (ADR) that focuses on

settling any tax disputes without involving Tax Appeals Tribunal. This is intended to achieve a win-win situation for both client and URA;

• Taxpayer education and sensitization drives;

• Introduction of the Customer Relationship Management model, where a taxpayer is assigned a URA officer to support and guide them on the compliance journey.