By Sarah M. Chelangat

The rental tax regime in Uganda has undergone numerous changes through amendments in the Income Tax Act. These changes are intended to find an acceptable rental tax regime that will increase the revenue collections from the sector as well as eliminate the unfairness caused to individual taxpayers to benefit companies.

Prior to the 2020 and 2021 amendments, individuals earning rental income were allowed a threshold, 20% of expenses incurred in generation of rental income and thereafter apply 20% rate to the chargeable income while companies were allowed all their expenses and 30% to the remaining chargeable income. This led to increased tax planning and revenue leakages as individuals structured their rental tax affairs through companies.

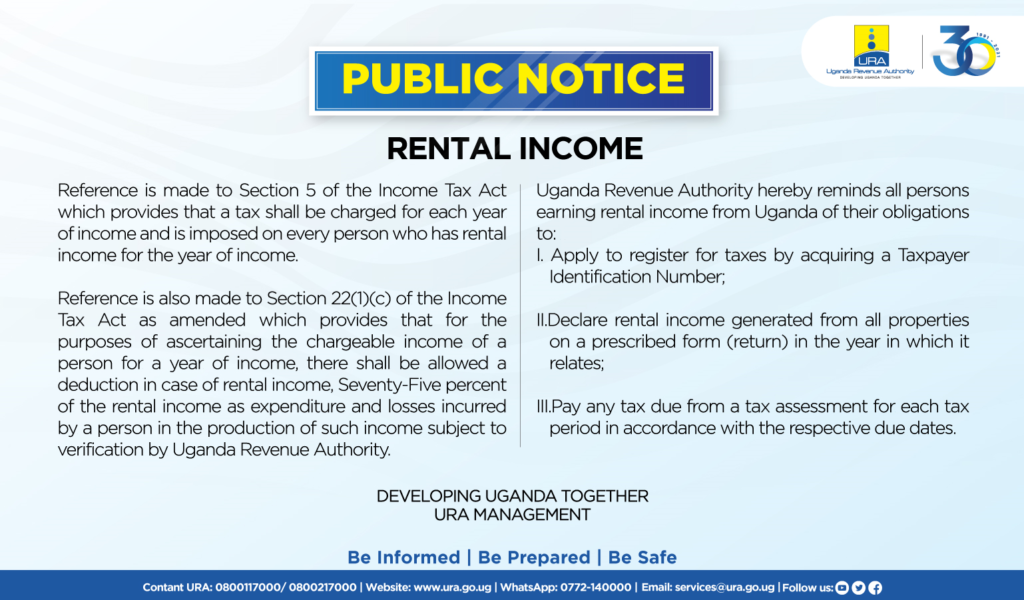

In the 2021 amendments, companies were allowed all expenses incurred in generation of rental income, while individuals were allowed only 75% of the expenses upon verification by URA. This approach was burdensome to both the taxpayer and URA.

However, the 2022 amendments to the rental tax regime have attempted to further simplify administration and collection of rental tax. The amendments re-introduce a threshold of UGX 2,820,000 and above to which a 12% flat rate is applied on the gross rental income per year for individuals.

An individual earning gross rental income of UGX 2,820,000/= and below per year will pay nil tax, while those earning above the threshold will pay 12% on the difference between their total gross rental income and the threshold. For example; if an individual earns a gross rental income of UGX 10,000,000/= in a year, the rental tax payable will be calculated as follows: (10,000,000 less 2,820,000(threshold)) x 12%. UGX 7,180,000 x 12% = UGX 861,600/=. This tax is payable in four quarterly installments that is; every three months.

This amended individual rental tax regime simplifies compliance because payments can even be made monthly via mobile money. For instance, in the illustration above, the taxpayer has to divide UGX7,180,000/= into twelve instalments and apply 12% which would translate into monthly rental tax of UGX71,800/=. This tax can be paid monthly using mobile money platforms thus eliminating the expense of engaging tax agents to file and pay rental tax.

The companies that have no threshold under the new rental tax regime but are allowed only 50% of the expenses after which, they apply 30% on the remaining chargeable income giving them an effective tax rate of 15%.

In Kenya, there are no expenses, losses or capital allowances allowed for deduction from the gross rent at the time of filing the return. Owners of residential properties whose gross rental income does not exceed Kshs 15 million shillings (approx. UGX 470 million) during a year of income are expected to pay rental income tax at a rate of 10% on the gross rent received either monthly, quarterly, semi-annually or annually. Therefore, a landlord earning gross rent of Kshs. 10,000 in a particular month will be required to pay rental income tax at the rate of 10%, that is 10%*10,000=1,000. Owners of residential properties whose gross rental income exceeds Kshs 15 million and owners of commercial properties are taxed at either the individual graduated scale or corporate rate of 30%.

The new rental tax regime therefore eliminates the burden of individuals keeping all records of expenses incurred in generating rental income and it imposes an effective tax rate of 12% for individuals which is lower than the 15% effective rate for companies. As URA, we are focusing on making the tax laws as simple as possible in order to allow all Ugandans contribute their fair share of tax.

The author is the Commissioner Domestic Taxes in URA