By Taxman Reporter

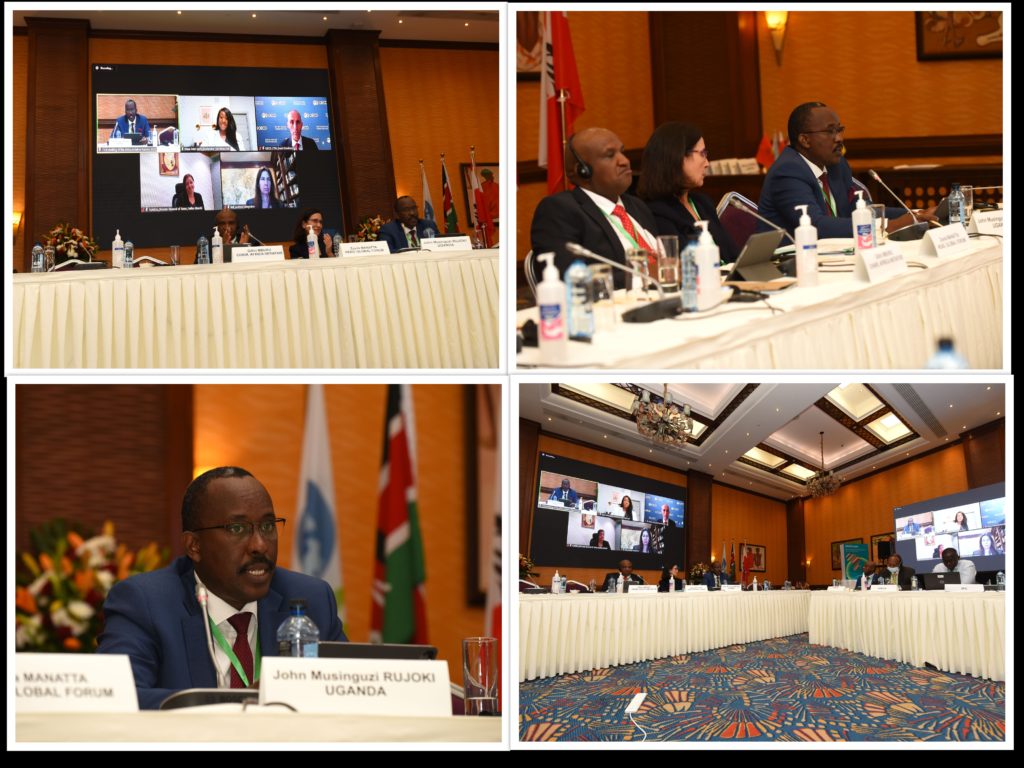

The Uganda Revenue Authority (URA) has realised a growth in revenue as a result of Exchange of information (EOI) from UGX 8,892,658 in 2014 to UGX 259,935,498,396 in 2021. URA’s Commissioner General John Rujoki Musinguzi, shared these statistics during the two-day meeting of Organisation for Economic Co-operation and Development Africa initiative (OECD) Global Forum on Transparency and EOI for Tax Purposes: 11th Africa Initiative held in Nairobi, Kenya.

African leaders in tax administration gathered in the East African country from 14th-16th June 2022 to strategise and unlock the potential of tax transparency and exchange of information for Africa to support resource mobilisation, especially in the post pandemic era.

Mr. Musinguzi presented a session on the role of EOI in Domestic Resource Mobilisation Strategies for Post-Covid Economic Recovery in Africa. He pointed out that the return on investment from the program is undeniable given the pronounced figures in revenue collection.

With reference to the Sustainable Development Goals, Musinguzi noted that tax transparency and exchange of information have been adopted as strategic interventions in the Uganda’s National Development Plan, the National Domestic Resource Mobilisation (DRM) Strategy and the five-year URA Corporate Plan 2020/21-2024/25. This, has provided a sure avenue to prioritise, resource and monitor the implementation of Exchange of Information as a tool for taxpayer compliance and revenue.

“Uganda considers exchange of information for tax purposes to be one of the key components of its national Domestic Resource Mobilisation strategy. The expectation is that EOI will improve the compliance management of Multinational Enterprises and individuals, including High Net-Worth Individuals,” Musinguzi said.

As the country is focusing on growing the domestic revenue docket, Musinguzi called on tax administrations in Africa to embrace EOI strategies aligned to the short, medium and long-term development priorities of the individual countries.

URA is one of the most advanced tax administrations in Africa in utilising EOI to tackle tax evasion and enhance revenue mobilisation.

Over the years, URA has banked on reliable and accurate information availed through EOI to accelerate tax compliance which has supported investigations and audits.

Organisation for Economic Co-operation and Development Africa initiative is a regional based program created to unlock the potential of tax transparency and exchange of information for Africa by ensuring that African countries are equipped to exploit the improvements in global transparency to better tackle tax evasion.

Created in 2014, the initiative aims to tackle cross-border illicit financial flows common on the continent such as tax evasion which dominantly stemmed from absence of economic transparency network.

The African initiative has facilitated EOI in 33 African countries including Uganda to support resource mobilisation for development. The initiative is currently chaired by Mr Githii Mburu, Commissioner General, Kenya Revenue Authority and co-chaired by Mr Edward Kieswetter, Commissioner, South African Revenue Service.