BY ANNET NANTONGO

From 21st January 2021, URA amended and migrated the credit note approval process from manual application to a now online process. Previously, In December 2021, taxpayers were required to seek written permission from URA, using a downloadable form, before issuing a credit note.

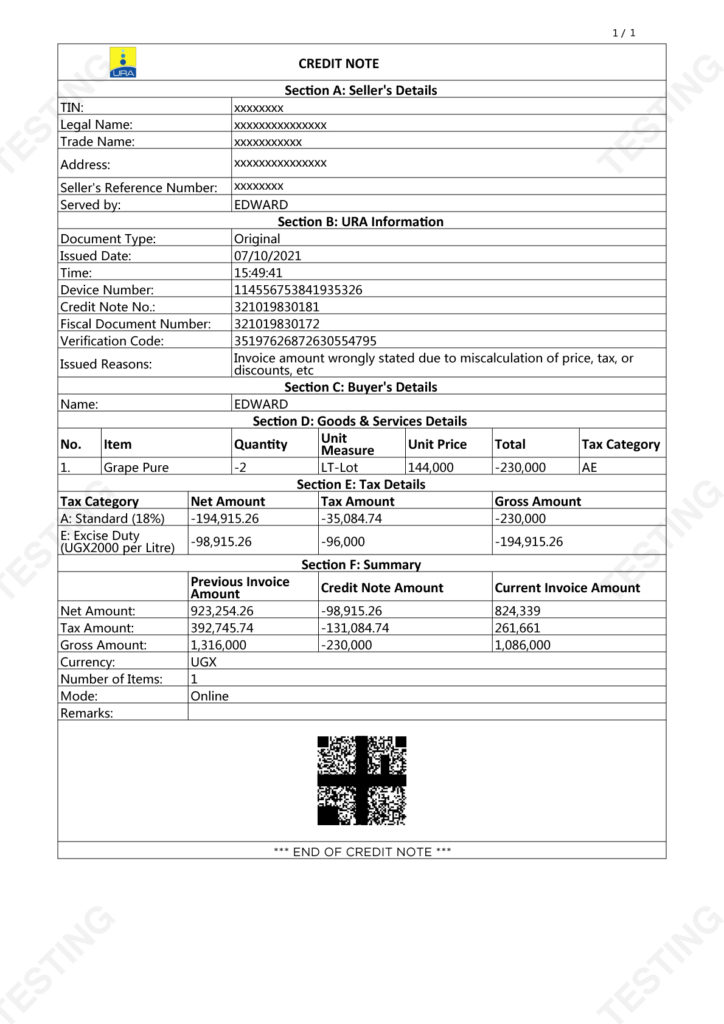

A Credit Note is an official document issued to a customer by a supplier when an earlier transaction needs to be cancelled or amended. It may also be issued when there is occurrence of an error in invoicing. It is essentially a legal document that allows the seller to amend an invoice without having to delete it.

Section 30 of the VAT Act provides that where a tax invoice has been issued in the circumstances specified in Section 22(1)(e) and the amount shown as tax charged in that tax invoice exceeds the tax properly chargeable in respect of the supply, the taxable person making the supply shall provide the recipient of the supply with a Credit Note.

Section 22 of the VAT Act provides circumstances that give rise to the issuing of Credit Notes, which include: a) cancellation of the supply; b) fundamental variation or alteration of the nature of the supply; c) alteration in the previously agreed consideration for the supply by agreement with the recipient of the supply, whether due to an offer of a discount or for any other reason; d) the goods or part of the goods have been returned to the supplier; e) the services or part of the services have been altered or cancelled; and f) there was an error in the original invoice issued by the supplier.

The same section in the VAT Act notes that taxpayers are supposed to issue credit notes when amending details on a fiscalised tax invoice. How this process is administered is to the discretion of the Commissioner General.

The new change of issuance of Credit Notes is aimed at combating tax fraud and ridding the economy of imbalances arising from requests for payment of tax refunds that are higher than the taxes collected from the VAT tax head.

The taxpayer will now initiate a Credit Note by logging on to their EFRIS account using http://efris/canvas/login. Thereafter, the applicant should go to Fiscal Document Management and click on Credit Note Application Menu. After, click on the Add button, input Fiscal Document Number (FDN) under Section A: Invoice/Receipt Details, then click outside the field for the page to auto populate.

The second step requires the applicant to fill out the contact person details in Section C by inputting Name, Mobile Number and Email. Proceed to Section D to indicate appropriate reasons for the credit note request. Under Section E: Supporting Document, select line item and click upload to add the taxpayer’s letter as per the acceptable file types, then proceed to next page under Goods/Services Details and make adjustments to the credit note as required.

Taxpayers are advised to delete line items that do not require adjustment. Subsequently, one adjusts by selecting the line item and clicking the Modify button. Capture the required adjustments under the fields for Unit of Measure, Quantity and Total (Tax inclusive) under Adjusted Amounts whichever is applicable, after which one submits and the application is then forwarded to the respective approver.

URA will then validate the taxpayer’s request for a Credit Note by confirming that the application meets the conditions stipulated under Sections 22 of the VAT Act as mentioned above.

Once URA is satisfied with the taxpayer’s application, the Credit Note issuance will be initiated. A notification is sent to the taxpayers account and registered email address once URA has taken action on the application. Upon approval, the seller and buyer will be able to view the detail of the credit note in their sales and purchases report respectively. If the application hasn’t met the required conditions as per the VAT Act, it will be rejected, and the taxpayer will be informed.

As URA deepens efforts to fight tax fraud, taxpayers are advised to adopt this change.

Click here to learn how to request for credit notes on EFRIS

Hello URA team,

Incase i entered wrong buyer’s details and i issued out the invoice , how can i make a credit note so that i enter the correct buyer’s details. thanks

Hello Derrick,

To cancel the invoice with erroneous buyer details, please follow the steps below;

1) Log into your EFRIS account

2) Click on Fiscal Document Management

3) Click Request Credit Note

4) Go to Add with FDN

5) Input Fiscal Document Number and search. Details of the invoice will appear at this point and you will proceed to apply

6) You will be required to add reasons for cancelling the invoice

7) Click on next, add any other remarks and click submit.

Cheers!