URA ENGAGES THE DEAF COMMUNITY ON AN INCLUSIVE TAX ADMINISTRATION

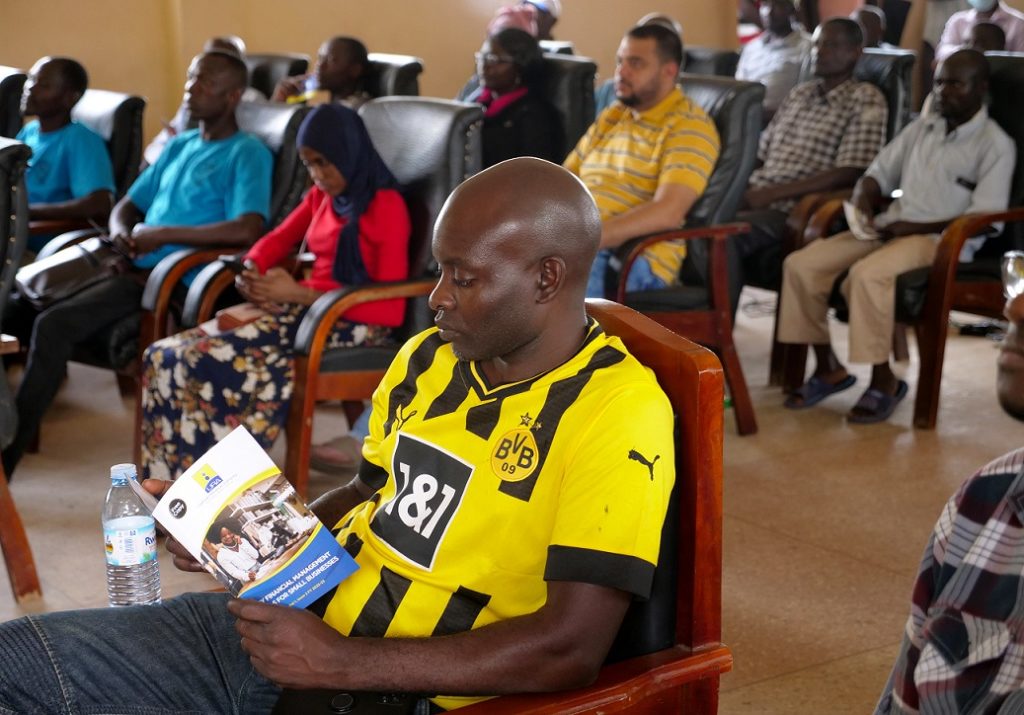

To improve voluntary compliance, Uganda Revenue Authority (URA) has camped in Iganga District to educate and support the Deaf community on their Tax rights and Tax obligations and how they can exploit the tax regime to grow their businesses. Through a public lecture premised on Opportunities for the Deaf in the Parish Development Model, URA …

URA ENGAGES THE DEAF COMMUNITY ON AN INCLUSIVE TAX ADMINISTRATION Read More »