The Digital Tracking Solution (DTS) is a track & trace platform that sends production and importation data for specific products immediately, to both Uganda Revenue Authority (URA) and Uganda National Bureau of Standards (UNBS). The Digital Tracking Solution involves the stamping of products with a digital stamp for tax purposes (URA) and conformity Stamps – for safety standards certification (UNBS).

Key terms used in Digital Tracking Solution

a) A Stamp Applicator: This is a device installed on the production line to automatically affix paper stamps to the product. It is mainly used by the spirit and wine manufacturers on their production lines

b) An Ejection System: This system automatically separates and pushes rejected products off the production line to a reject collecting section. It is mainly used to remove product rejects as programmed on the line.

c) Line Enable: This is the term given to the connection between the DTS equipment and the manufacturer’s equipment. It enables the manufacturer’s equipment to feed the DTS equipment with production details.

Digital Tax Stamps These are markings applied to goods or their packaging and contain; security features and codes to prevent counterfeiting of goods and enable them to be tracked and traced.

How does a Digital Tax Stamp look like?

All Domestic and Importers of Juices, Non-alcoholic and Alcoholic Beverages (Manual Stamping)

| Product category | Unit Price (UGX) |

| Beer | 36 |

| Spirits | 110 |

| Fruit Juice and Vegetable Juice | 17 |

| Any other fermented beverages | 35 |

| Any other alcoholic beverages | 35 |

| Cooking oil | 40 |

| Sugar | 39 |

| Soda | 17 |

| Wine | 110 |

| Mineral water or bottled water | 13 |

| Any other non-alcoholic beverages | 17 |

| Tobacco products | 75 |

| Cement | 135 |

| Cement bulker | 60,000 |

NOTE:

The Digital Tracking Solution is used by both local manufacturers and importers of products, specified by the Commissioner by a notice in a gazette and it is mandatory for these taxpayers to apply tax stamps. This means that such products are not allowed on the Ugandan market unless they have digital tax stamps.

Why did URA introduce Digital Tax Stamps?

URA introduced digital tax stamps to address the following challenges:

a) Suppression of production and import figures

b) Suppression of local excise duty payable

c) Increased Illicit trade

d) Increased smuggling of excisable products

What is the procedure of acquiring DTS?

Manufacturers and importers can acquire DTS using the following procedures;

a) Registration – Register for DTS online through the URA portal (http://ura.go.ug), under e-services (Digital tracking Solution) as an importer or manufacturer.

b) Order and payment of stamp fees – Make forecasts, orders and payment for stamps. When payment is cleared, you will receive confirmation via email notification to collect your stamps. Payment for such stamps is a business expense that is allowed when one is accounting for their taxes.

c) Delivery, affixing and activation of stamps – Digital stamps shall be picked by the company’s authorized person from SICPA (U) office on the address indicated below if you are manually stamping goods or using paper stamps. However, if you are using automated production lines the codes/stamps will be automatically up loaded on to your DTS machine. The designated recipient for the stamps MUST present: –

o National ID or Passport

o Employee ID or letter from employer

o Company Stamp to acknowledge Delivery Notes

Locations where Digital Tax Stamps shall be picked

| Provider | Directions | Location coordinates |

| SICPA Uganda Limited Henley Business Park, Ntinda Industrial Area P.O. Box 30330 KAMPALA | From Jinja road (Nakawa-NaguruNtinda junction) take Stretcher Road for about 1km, at Shell stretcher service station, turn right and continue for just about 50m at the turn, Henley business Park in on your right, directly opposite Wispro (U) Ltd. | Henley Business Park Kampala 0.340632, 32.616436 |

Note:

Importers may stamp from the good’s country of origin or manually at their registered premises in Uganda.

c) Activation of stamps – Stamps shall be activated automatically (using DTS equipment) or manually online using the DAS (Digital Activation System)

d) Viewing of reports – The importer or manufacturer may view reports on their orders and activations.

| Category of manufacturers/ importer | Requirements to use DTS |

| Manufacturers with automated production lines | a) Register for DTS. b) Adjust for or make space for DTS equipment on production line if fully automated. c) Acquire a stamp applicator, if in production of spirits or wines. d) Provide for a line ejection functionality, if the system does not already exist on your production line. e) Provide a secure server room, if this does not already exist. f) Provide network cabling within the factory to enable the DTS equipment on each line to transmit production data to the DTS master server in the entity’s server room. g) Provide a broadband internet connection with a dedicated IP address to enable the DTS master server to transmit production data to the DTS central database at URA. h) Provide a clean power source for all DTS elements (on each line and in the server room). i) Space for secure cabinets for spare parts, tools and consumables that are required for system operation, maintenance and support. |

| Manufacturers with manual production process and importers | a) Register for DTS. b) Provide labor to manually affix tax stamps. |

Exports of the gazette products do not require digital tax stamps. Products for export are monitored through:

a) Counting and recording

b) Marking for Export

c) Accompanying with documentary evidence including certified copies of the customs export documents when being transported to point of exit.

d) NOT supposed to be found in the local market

Benefits of DTS

a) Ability to conveniently verify and trace all specified goods throughout the distribution chain

b) Make instant requests for report of one’s daily, weekly, monthly transactions

c) Improved record keeping since one can track their transactions

d) Facilitation to comply through immediate access of details of your production/imports which in turn facilitates easy processing of VAT refunds and quickens return filing

e) For importers, the system quickens customs clearing as the information would have been captured beforehand

f) Reduction in smuggling and dumping of goods hence controlling illicit trade and encouraging fair market competition

Responsibilities in DTS

| Category | Responsibilities |

| Manufactures/ importers | If dealing in excisable goods, install the DTS on production lines. |

| Consumers | Consume ONLY stamped gazetted products. This will protect them from counterfeit or hazardous products. |

| Distributor, agent or stockist | Should distribute, stock or deal in only stamped gazette products |

| Category | How to validate | Evidence |

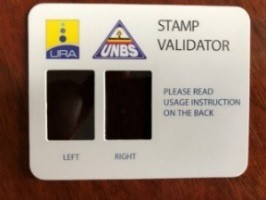

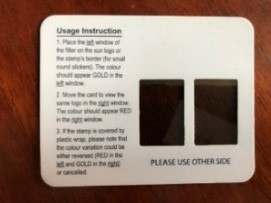

| Distributor, agent or stockist | Use a stamp validator as seen on the side to verify the authenticity of a tax stamp affixed on a product locally manufactured or imported. |   |

| Consumer | A downloadable app called “KAKASA Digital Tracking Solution” accessible on google play store or Apple store can be downloaded using your smart phone. You shall be able to scan the QR code and a report availed immediately, on whether the stamp is valid or NOT. For those with non-smart phones, “Kabiriti” phones, you shall be able to type the Code on the stamp and send an SMS to 8119 and a report shall be availed to you |  |

a) Consumer empowerment:

This is done through the use of the KAKASA App. Using the URA you tube link, one can get an online tutorial “How to use the KAKASA App”

b) Stockist, agents and distributor empowerment:

This is done through use of the STAMP VALIDATOR

c) Enforcement:

URA is enforcing compliance through the use of a special enforcement gadget and other intelligence measures

| S/N | Offence | Penalty |

| a) | Failure to affix a stamp on gazetted goods | Penal tax equivalent to double the tax due on goods or fifty (50) million shillings, whichever is higher |

| b) | Printing over or defacing a tax stamp affixed on gazetted goods | Penal tax equivalent to double the tax due on goods or twenty (20) million shillings, whichever is higher |

| c) | Possession of gazetted goods on which a tax stamp is not affixed | Penal tax equivalent to double the tax due on goods or fifty (50) million shillings, whichever is higher |

| d) | Attempting to acquire or acquire or sell a tax stamp without the authority of the Commissioner | Penalty equivalent to double the tax due on the goods or ten million shillings, whichever is higher |